Page 2 - Watauga FY22-23 Budget

P. 2

Filed 09/25/2023 2:36:37 PM

Tarrant County Clerk's Office

Mary Louise Nicholson,

County Clerk

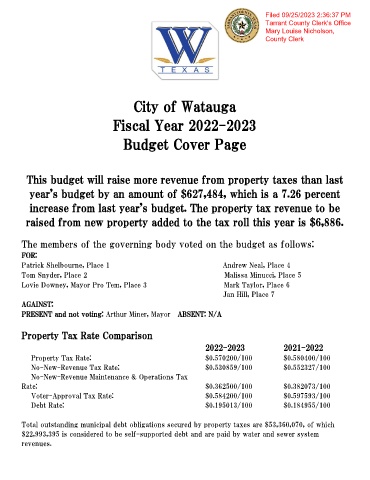

City of Watauga

Fiscal Year 2022-2023

Budget Cover Page

This budget will raise more revenue from property taxes than last

year's budget by an amount of $627,484, which is a 7.26 percent

increase from last year's budget. The property tax revenue to be

raised from new property added to the tax roll this year is $6,886.

The members of the governing body voted on the budget as follows:

FOR:

Patrick Shelbourne, Place 1 Andrew Neal, Place 4

Tom Snyder, Place 2 Malissa Minucci, Place 5

Lovie Downey, Mayor Pro Tem, Place 3 Mark Taylor, Place 6

Jan Hill, Place 7

AGAINST:

PRESENT and not voting: Arthur Miner, Mayor ABSENT: N/A

Property Tax Rate Comparison

2022-2023 2021-2022

Property Tax Rate: $0.570200/100 $0.580400/100

No-New-Revenue Tax Rate: $0.530859/100 $0.552327/100

No-New-Revenue Maintenance & Operations Tax

Rate: $0.362500/100 $0.382073/100

Voter-Approval Tax Rate: $0.584200/100 $0.597593/100

Debt Rate: $0.195013/100 $0.184955/100

Total outstanding municipal debt obligations secured by property taxes are $53,360,070, of which

$22,993,395 is considered to be self-supported debt and are paid by water and sewer system

revenues.