Page 301 - GFOA Draft 2

P. 301

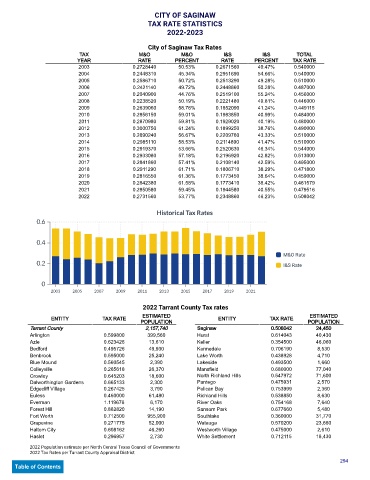

CITY OF SAGINAW

TAX RATE STATISTICS

2022-2023

City of Saginaw Tax Rates

TAX M&O M&O I&S I&S TOTAL

YEAR RATE PERCENT RATE PERCENT TAX RATE

2003 0.2728440 50.53% 0.2671560 49.47% 0.540000

2004 0.2448310 45.34% 0.2951690 54.66% 0.540000

2005 0.2586710 50.72% 0.2513290 49.28% 0.510000

2006 0.2421140 49.72% 0.2448860 50.28% 0.487000

2007 0.2040900 44.76% 0.2519100 55.24% 0.456000

2008 0.2238520 50.19% 0.2221480 49.81% 0.446000

2009 0.2639060 58.76% 0.1852090 41.24% 0.449115

2010 0.2856150 59.01% 0.1983850 40.99% 0.484000

2011 0.2870980 59.81% 0.1929020 40.19% 0.480000

2012 0.3000750 61.24% 0.1899250 38.76% 0.490000

2013 0.2890240 56.67% 0.2209760 43.33% 0.510000

2014 0.2985110 58.53% 0.2114890 41.47% 0.510000

2015 0.2919370 53.66% 0.2520630 46.34% 0.544000

2016 0.2933080 57.18% 0.2196920 42.82% 0.513000

2017 0.2841860 57.41% 0.2108140 42.59% 0.495000

2018 0.2911290 61.71% 0.1806710 38.29% 0.471800

2019 0.2816550 61.36% 0.1773450 38.64% 0.459000

2020 0.2842380 61.58% 0.1773410 38.42% 0.461579

2021 0.2850580 59.45% 0.1944580 40.55% 0.479516

2022 0.2731560 53.77% 0.2348860 46.23% 0.508042

Historical Tax Rates

0.6

0.4

M&O Rate

0.2 I&S Rate

0

2003 2005 2007 2009 2011 2013 2015 2017 2019 2021

2022 Tarrant County Tax rates

ESTIMATED ESTIMATED

ENTITY TAX RATE ENTITY TAX RATE

POPULATION POPULATION

Tarrant County 2,157,740 Saginaw 0.508042 24,450

Arlington 0.599800 399,560 Hurst 0.614043 40,430

Azle 0.623426 13,610 Keller 0.354500 46,060

Bedford 0.495726 49,930 Kennedale 0.706190 8,530

Benbrook 0.595000 25,240 Lake Worth 0.438928 4,710

Blue Mound 0.560545 2,390 Lakeside 0.493500 1,660

Colleyville 0.265618 26,370 Mansfield 0.680000 77,040

Crowley 0.645203 18,600 North Richland Hills 0.547972 71,600

Dalworthington Gardens 0.665133 2,300 Pantego 0.475931 2,570

Edgecliff Village 0.267425 3,790 Pelican Bay 0.753999 2,360

Euless 0.460000 61,480 Richland Hills 0.538850 8,630

Everman 1.119676 6,170 River Oaks 0.754168 7,640

Forest Hill 0.882820 14,190 Sansom Park 0.677660 5,480

Fort Worth 0.712500 955,900 Southlake 0.360000 31,770

Grapevine 0.271775 52,000 Watauga 0.570200 23,660

Haltom City 0.608162 46,260 Westworth Village 0.475000 2,610

Haslet 0.296957 2,730 White Settlement 0.712115 18,430

2022 Population estimate per North Central Texas Council of Governments

2022 Tax Rates per Tarrant County Appraisal District

294

Table of Contents