Page 2 - GFOA Draft 2

P. 2

Filed

Tarrant County Clerk

2023 Jan 19 8:47 AM

Mary Louise Nicholson

County Clerk

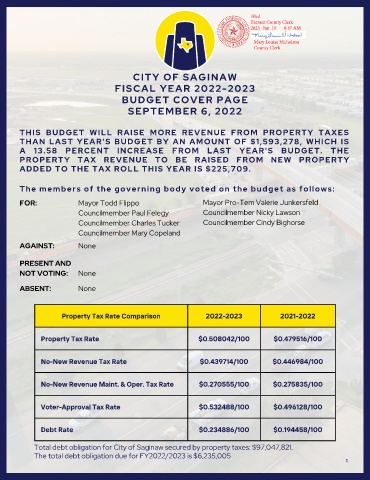

CITY OF SAGINAW

FISCAL YEAR 2022-2023

BUDGET COVER PAGE

SEPTEMBER 6, 2022

THIS BUDGET WILL RAISE MORE REVENUE FROM PROPERTY TAXES

THAN LAST YEAR'S BUDGET BY AN AMOUNT OF $1,593,278, WHICH IS

A 13.58 PERCENT INCREASE FROM LAST YEAR'S BUDGET. THE

PROPERTY TAX REVENUE TO BE RAISED FROM NEW PROPERTY

ADDED TO THE TAX ROLL THIS YEAR IS $225,709.

The members of the governing body voted on the budget as follows:

FOR: Mayor Todd Flippo Mayor Pro-Tem Valerie Junkersfeld

Councilmember Paul Felegy Councilmember Nicky Lawson

Councilmember Charles Tucker Councilmember Cindy Bighorse

Councilmember Mary Copeland

AGAINST: None

PRESENT AND

NOT VOTING: None

ABSENT: None

Property Tax Rate Comparison 2022-2023 2021-2022

Property Tax Rate $0.508042/100 $0.479516/100

No-New Revenue Tax Rate $0.439714/100 $0.446984/100

No-New Revenue Maint. & Oper. Tax Rate $0.270555/100 $0.275835/100

Voter-Approval Tax Rate $0.532488/100 $0.496128/100

Debt Rate $0.234886/100 $0.194458/100

Total debt obligation for City of Saginaw secured by property taxes: $97,047,821.

The total debt obligation due for FY2022/2023 is $6,235,005

1