Page 6 - Lake Worth FY23 Adopted Budget Ord 1241

P. 6

CITY OF LAKE WORTH

SUPPLEMENTAL INFORMATION

RELATED TO THE PROPOSED BUDGET

FOR FISCAL YEAR ENDING 09/ 30/ 23

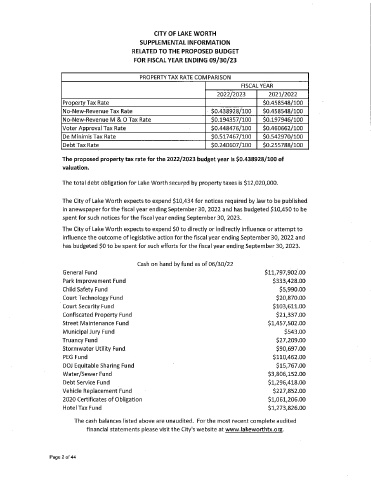

PROPERTY TAX RATE COMPARISON

FISCAL YEAR

2022/ 2023 2021/ 2022

Property Tax Rate 0.458548/ 100

No -New -Revenue Tax Rate 0.438928/ 100 0.458548/ 100

No -New -Revenue M & O Tax Rate 0. 194357/ 100 0. 197946/ 100

Voter Approval Tax Rate 0.448476/ 100 0,460662/ 100

De Minimis Tax Rate 0.517467/ 100 0. 542970/ 100

Debt Tax Rate 0. 240607/ 100 0. 255788/ 100

The proposed property tax rate for the 2022/ 2023 budget year is $ 0.438928/ 100 of

valuation.

The total debt obligation for Lake Worth secured by property taxes is $ 12,020,000.

The City of Lake Worth expects to expend $ 10,434 for notices required by law to be published

in anewspaper for the fiscal year ending September 30, 2022 and has budgeted $10,450 to be

spent for such notices for the fiscal year ending September 30, 2023.

The City of Lake Worth expects to expend $0 to directly or indirectly influence or attempt to

influence the outcome of legislative action for the fiscal year ending September 30, 2022 and

has budgeted $0 to be spent for such efforts for the fiscal year ending September 30, 2023.

Cash on hand by fund as of 06/ 30/ 22

General Fund $ 11, 797,902.00

Park Improvement Fund $ 333,428.00

Child Safety Fund $ 5, 990000

Court Technology Fund $ 20, 870.00

Court Security Fund $ 103, 611.00

Confiscated Property Fund $ 21, 337.00

Street Maintenance Fund $ 1, 457, 502900

Municipal Jury Fund $ 543. 00

Truancy Fund $ 27, 209.00

Stormwater Utility Fund $ 90, 697. 00

PEG Fund $ 110,462.00

DOJ Equitable Sharing Fund $ 15, 767.00

Water/ Sewer Fund $ 3, 806, 152. 00

Debt Service Fund $ 1, 296,418.00

Vehicle Replacement Fund $ 227, 852900

2020 Certificates of Obligation $ 1, 061, 206.00

Hotel Tax Fund $ 1, 273, 826.00

The cash balances listed above are unaudited. For the most recent complete audited

financial statements please visit the City's website at www.lakeworthtx.ore.

Page 2 of 44