Page 136 - CityofKennedaleFY23Budget

P. 136

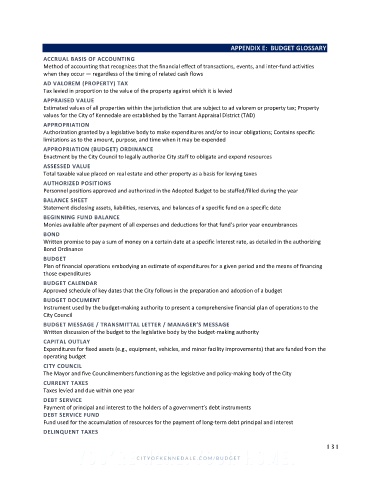

APPENDIX E: BUDGET GLOSSARY

ACCRUAL BASIS OF ACCOUNTING

Method of accounting that recognizes that the financial effect of transactions, events, and inter-fund activities

when they occur — regardless of the timing of related cash flows

AD VALOREM (PROPERTY) TAX

Tax levied in proportion to the value of the property against which it is levied

APPRAISED VALUE

Estimated values of all properties within the jurisdiction that are subject to ad valorem or property tax; Property

values for the City of Kennedale are established by the Tarrant Appraisal District (TAD)

APPROPRIATION

Authorization granted by a legislative body to make expenditures and/or to incur obligations; Contains specific

limitations as to the amount, purpose, and time when it may be expended

APPROPRIATION (BUDGET) ORDINANCE

Enactment by the City Council to legally authorize City staff to obligate and expend resources

ASSESSED VALUE

Total taxable value placed on real estate and other property as a basis for levying taxes

AUTHORIZED POSITIONS

Personnel positions approved and authorized in the Adopted Budget to be staffed/filled during the year

BALANCE SHEET

Statement disclosing assets, liabilities, reserves, and balances of a specific fund on a specific date

BEGINNING FUND BALANCE

Monies available after payment of all expenses and deductions for that fund’s prior year encumbrances

BOND

Written promise to pay a sum of money on a certain date at a specific interest rate, as detailed in the authorizing

Bond Ordinance

BUDGET

Plan of financial operations embodying an estimate of expenditures for a given period and the means of financing

those expenditures

BUDGET CALENDAR

Approved schedule of key dates that the City follows in the preparation and adoption of a budget

BUDGET DOCUMENT

Instrument used by the budget-making authority to present a comprehensive financial plan of operations to the

City Council

BUDGET MESSAGE / TRANSMITTAL LETTER / MANAGER’S MESSAGE

Written discussion of the budget to the legislative body by the budget-making authority

CAPITAL OUTLAY

Expenditures for fixed assets (e.g., equipment, vehicles, and minor facility improvements) that are funded from the

operating budget

CITY COUNCIL

The Mayor and five Councilmembers functioning as the legislative and policy-making body of the City

CURRENT TAXES

Taxes levied and due within one year

DEBT SERVICE

Payment of principal and interest to the holders of a government’s debt instruments

DEBT SERVICE FUND

Fund used for the accumulation of resources for the payment of long-term debt principal and interest

DELINQUENT TAXES

1 31