Page 79 - HurstFY23AnnualBudget

P. 79

APPROVED BUDGET FISCAL YEAR 2022-2023

REVENUE

DESCRIPTIONS, EVALUATIONS AND PROJECTIONS

TAXES

The revenues from taxes are classified as General Property Taxes, Consumer Taxes and Franchise

Taxes in the General Fund operating budget. These charges are levied to provide for general

municipal services and benefits to the citizens.

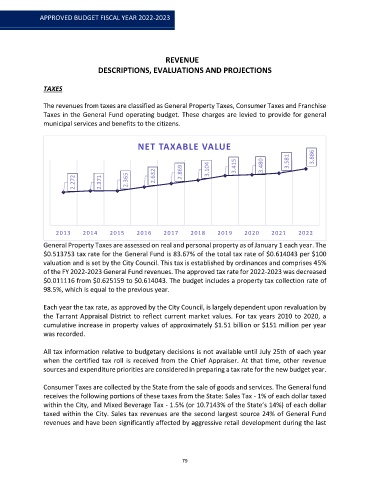

NET TAXABLE VALUE 3.581 3.886

2.272 2.371 2.365 2.632 2.869 3.104 3.415 3.480

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

General Property Taxes are assessed on real and personal property as of January 1 each year. The

$0.513753 tax rate for the General Fund is 83.67% of the total tax rate of $0.614043 per $100

valuation and is set by the City Council. This tax is established by ordinances and comprises 45%

of the FY 2022-2023 General Fund revenues. The approved tax rate for 2022-2023 was decreased

$0.011116 from $0.625159 to $0.614043. The budget includes a property tax collection rate of

98.5%, which is equal to the previous year.

Each year the tax rate, as approved by the City Council, is largely dependent upon revaluation by

the Tarrant Appraisal District to reflect current market values. For tax years 2010 to 2020, a

cumulative increase in property values of approximately $1.51 billion or $151 million per year

was recorded.

All tax information relative to budgetary decisions is not available until July 25th of each year

when the certified tax roll is received from the Chief Appraiser. At that time, other revenue

sources and expenditure priorities are considered in preparing a tax rate for the new budget year.

Consumer Taxes are collected by the State from the sale of goods and services. The General fund

receives the following portions of these taxes from the State: Sales Tax - 1% of each dollar taxed

within the City, and Mixed Beverage Tax - 1.5% (or 10.7143% of the State’s 14%) of each dollar

taxed within the City. Sales tax revenues are the second largest source 24% of General Fund

revenues and have been significantly affected by aggressive retail development during the last

79