Page 3 - HurstFY23AnnualBudget

P. 3

APPROVED BUDGET FISCAL YEAR 2022-2023

11/23/2022 11:58AM

City of Hurst

Annual Budget Plan and Municipal Services

Fiscal Year 2022-2023

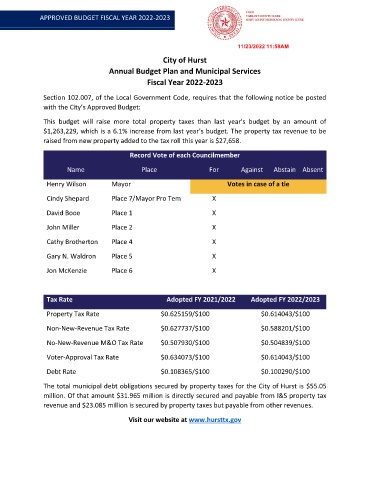

Section 102.007, of the Local Government Code, requires that the following notice be posted

with the City’s Approved Budget:

This budget will raise more total property taxes than last year's budget by an amount of

$1,263,229, which is a 6.1% increase from last year’s budget. The property tax revenue to be

raised from new property added to the tax roll this year is $27,658.

Record Vote of each Councilmember

Name Place For Against Abstain Absent

Henry Wilson Mayor Votes in case of a tie

Cindy Shepard Place 7/Mayor Pro Tem X

David Booe Place 1 X

John Miller Place 2 X

Cathy Brotherton Place 4 X

Gary N. Waldron Place 5 X

Jon McKenzie Place 6 X

Tax Rate Adopted FY 2021/2022 Adopted FY 2022/2023

Property Tax Rate $0.625159/$100 $0.614043/$100

Non-New-Revenue Tax Rate $0.627737/$100 $0.588201/$100

No-New-Revenue M&O Tax Rate $0.507930/$100 $0.504839/$100

Voter-Approval Tax Rate $0.634073/$100 $0.614043/$100

Debt Rate $0.108365/$100 $0.100290/$100

The total municipal debt obligations secured by property taxes for the City of Hurst is $55.05

million. Of that amount $31.965 million is directly secured and payable from I&S property tax

revenue and $23.085 million is secured by property taxes but payable from other revenues.

Visit our website at www.hursttx.gov