Page 145 - HurstFY23AnnualBudget

P. 145

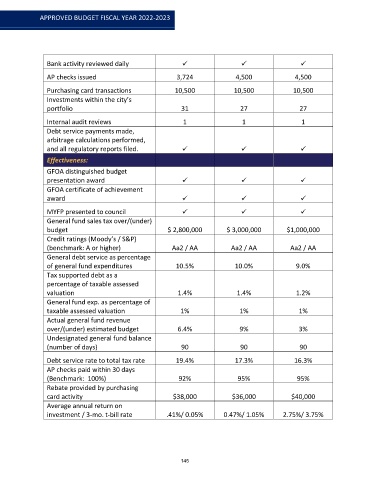

APPROVED BUDGET FISCAL YEAR 2022-2023

Bank activity reviewed daily ✓ ✓ ✓

AP checks issued 3,724 4,500 4,500

Purchasing card transactions 10,500 10,500 10,500

Investments within the city’s

portfolio 31 27 27

Internal audit reviews 1 1 1

Debt service payments made,

arbitrage calculations performed,

and all regulatory reports filed. ✓ ✓ ✓

Effectiveness:

GFOA distinguished budget

presentation award ✓ ✓ ✓

GFOA certificate of achievement

award ✓ ✓ ✓

MYFP presented to council ✓ ✓ ✓

General fund sales tax over/(under)

budget $ 2,800,000 $ 3,000,000 $1,000,000

Credit ratings (Moody’s / S&P)

(benchmark: A or higher) Aa2 / AA Aa2 / AA Aa2 / AA

General debt service as percentage

of general fund expenditures 10.5% 10.0% 9.0%

Tax supported debt as a

percentage of taxable assessed

valuation 1.4% 1.4% 1.2%

General fund exp. as percentage of

taxable assessed valuation 1% 1% 1%

Actual general fund revenue

over/(under) estimated budget 6.4% 9% 3%

Undesignated general fund balance

(number of days) 90 90 90

Debt service rate to total tax rate 19.4% 17.3% 16.3%

AP checks paid within 30 days

(Benchmark: 100%) 92% 95% 95%

Rebate provided by purchasing

card activity $38,000 $36,000 $40,000

Average annual return on

investment / 3-mo. t-bill rate .41%/ 0.05% 0.47%/ 1.05% 2.75%/ 3.75%

145