Page 52 - Grapevine FY23 Adopted Budget (1)

P. 52

Current Economic Trends Impacting Long-Range Forecasting

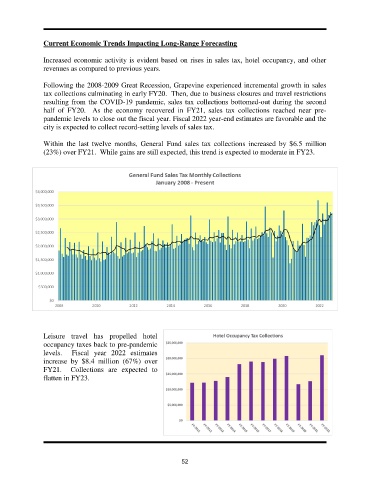

Increased economic activity is evident based on rises in sales tax, hotel occupancy, and other

revenues as compared to previous years.

Following the 2008-2009 Great Recession, Grapevine experienced incremental growth in sales

tax collections culminating in early FY20. Then, due to business closures and travel restrictions

resulting from the COVID-19 pandemic, sales tax collections bottomed-out during the second

half of FY20. As the economy recovered in FY21, sales tax collections reached near pre-

pandemic levels to close out the fiscal year. Fiscal 2022 year-end estimates are favorable and the

city is expected to collect record-setting levels of sales tax.

Within the last twelve months, General Fund sales tax collections increased by $6.5 million

(23%) over FY21. While gains are still expected, this trend is expected to moderate in FY23.

Leisure travel has propelled hotel

occupancy taxes back to pre-pandemic

levels. Fiscal year 2022 estimates

increase by $8.4 million (67%) over

FY21. Collections are expected to

flatten in FY23.

52