Page 44 - Grapevine FY23 Adopted Budget (1)

P. 44

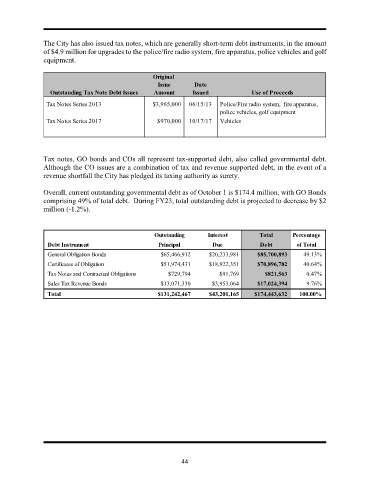

The City has also issued tax notes, which are generally short-term debt instruments, in the amount

of $4.9 million for upgrades to the police/fire radio system, fire apparatus, police vehicles and golf

equipment.

Original

Issue Date

Outstanding Tax Note Debt Issues Amount Issued Use of Proceeds

Tax Notes Series 2013 $3,965,000 06/15/13 Police/Fire radio system, fire apparatus,

police vehicles, golf equipment

Tax Notes Series 2017 $970,000 10/17/17 Vehicles

Tax notes, GO bonds and COs all represent tax-supported debt, also called governmental debt.

Although the CO issues are a combination of tax and revenue supported debt, in the event of a

revenue shortfall the City has pledged its taxing authority as surety.

Overall, current outstanding governmental debt as of October 1 is $174.4 million, with GO Bonds

comprising 49% of total debt. During FY23, total outstanding debt is projected to decrease by $2

million (-1.2%).

Outstanding Interest Total Percentage

Debt Instrument Principal Due Debt of Total

General Obligation Bonds $65,466,912 $20,233,981 $85,700,893 49.13%

Certificates of Obligation $51,974,431 $18,922,351 $70,896,782 40.64%

Tax Notes and Contractual Obligations $729,794 $91,769 $821,563 0.47%

Sales Tax Revenue Bonds $13,071,330 $3,953,064 $17,024,394 9.76%

Total $131,242,467 $43,201,165 $174,443,632 100.00%

44