Page 287 - Grapevine FY23 Adopted Budget (1)

P. 287

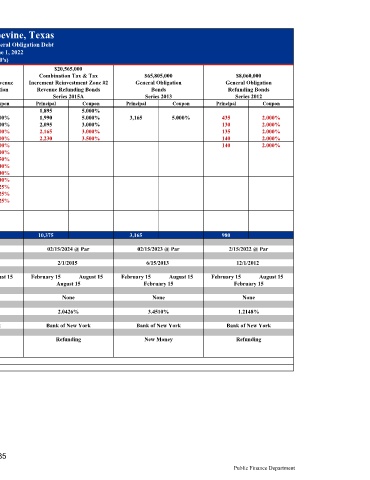

$8,060,000 General Obligation Refunding Bonds Series 2012 Coupon Principal 2.000% 435 2.000% 130 2.000% 135 2.000% 140 2.000% 140 980 2/15/2022 @ Par 12/1/2012 August 15 February 15 February 15 None 1.2148% Bank of New York Refunding Public Finance Department

$65,805,000 General Obligation Bonds Series 2013 Coupon Principal 5.000% 3,165 3,165 02/15/2023 @ Par 6/15/2013 August 15 February 15 February 15 None 3.4510% Bank of New York New Money

Combination Tax & Tax Revenue Refunding Bonds Coupon 5.000% 5.000% 3.000% 3.000% 3.500% August 15 None Bank of New York Refunding

$20,565,000 Increment Reinvestment Zone #2 Series 2015A Principal 1,895 1,990 2,095 2,165 2,230 10,375 02/15/2024 @ Par 2/1/2015 February 15 August 15 2.0426%

City of Grapevine, Texas

As of June 1, 2022 All Outstanding General Obligation Debt (000's) $11,720,000 Combination Tax & Revenue Certificates of Obligation Series 2015 Coupon Principal 2.500% 515 3.000% 525 3.000% 555 3.500% 575 4.000% 590 4.000% 615 4.250% 635 4.500% 670 3.000% 610 3.000% 640 3.125% 655 3.125% 680 3.125% 685 7,950 02/15/2024 @ Par 2/1/2015 August 15 February 15 August 15 None 2.0426% Bank of New York New Money 285

$14,695,000 General Obligation Refunding Bonds Series 2015 Coupon Principal 3.000% 240 3.000% 250 3.000% 260 3.000% 270 1,020 02/15/2024 @ Par 2/1/2015 August 15 February 15 February 15 None 2.0426% Bank of New York Refunding Callable

$3,070,000 Public Property Finance Contractual Obligations Series 2015 Coupon Principal 4.000% 65 4.000% 70 4.000% 70 4.000% 75 280 Non-Callable 2/1/2015 August 15 February 15 February 15 None 1.5029% Bank of New York New Money Color Legend Non-Callable

Year Ending September 30 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 TOTALS Next Call Dated Date Coupon Dates Maturity Dates Insurer Arbitrage Yield Paying Agent Purpose