Page 271 - Grapevine FY23 Adopted Budget (1)

P. 271

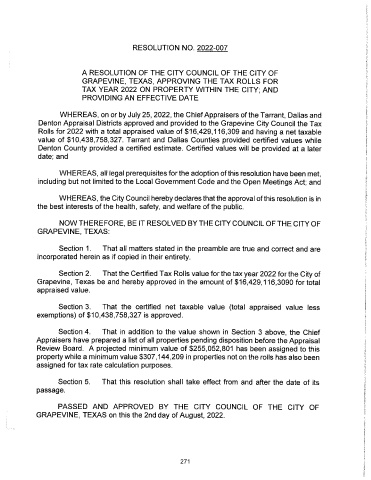

RESOLUTION NO. 2022- 007

A RESOLUTION OF THE CITY COUNCIL OF THE CITY OF

GRAPEVINE, TEXAS, APPROVING THE TAX ROLLS FOR

TAX YEAR 2022 ON PROPERTY WITHIN THE CITY; AND

PROVIDING AN EFFECTIVE DATE

WHEREAS, on or by July 25, 2022, the Chief Appraisers of the Tarrant, Dallas and

Denton Appraisal Districts approved and provided to the Grapevine City Council the Tax

Rolls for 2022 with a total appraised value of $ 16,429, 116,309 and having a net taxable

value of $ 10,438,758, 327. Tarrant and Dallas Counties provided certified values while

Denton County provided a certified estimate. Certified values will be provided at a later

date; and

WHEREAS, all legal prerequisites for the adoption of this resolution have been met,

including but not limited to the Local Government Code and the Open Meetings Act; and

WHEREAS, the City Council hereby declares that the approval of this resolution is in

the best interests of the health, safety, and welfare of the public.

NOW THEREFORE, BE IT RESOLVED BY THE CITY COUNCIL OF THE CITY OF

GRAPEVINE, TEXAS:

Section 1. That all matters stated in the preamble are true and correct and are

incorporated herein as if copied in their entirety.

Section 2. That the Certified Tax Rolls value for the tax year 2022 for the City of

Grapevine, Texas be and hereby approved in the amount of $ 16, 429, 116, 3090 for total

appraised value.

Section 3. That the certified net taxable value ( total appraised value less

exemptions) of $ 10, 438, 758, 327 is approved.

Section 4. That in addition to the value shown in Section 3 above, the Chief

Appraisers have prepared a list of all properties pending disposition before the Appraisal

Review Board. A projected minimum value of $ 255,052, 801 has been assigned to this

property while a minimum value $ 307, 144,209 in properties not on the rolls has also been

assigned for tax rate calculation purposes.

Section 5. That this resolution shall take effect from and after the date of its

passage.

PASSED AND APPROVED BY THE CITY COUNCIL OF THE CITY OF

GRAPEVINE, TEXAS on this the 2nd day of August, 2022.

271