Page 40 - FortWorthFY23AdoptedBudget

P. 40

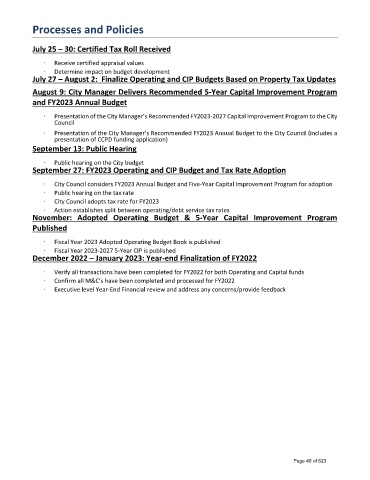

Processes and Policies

July 25 – 30: Certified Tax Roll Received

· Receive certified appraisal values

· Determine impact on budget development

July 27 – August 2: Finalize Operating and CIP Budgets Based on Property Tax Updates

August 9: City Manager Delivers Recommended 5-Year Capital Improvement Program

and FY2023 Annual Budget

· Presentation of the City Manager’s Recommended FY2023-2027 Capital Improvement Program to the City

Council

· Presentation of the City Manager’s Recommended FY2023 Annual Budget to the City Council (includes a

presentation of CCPD funding application)

September 13: Public Hearing

· Public hearing on the City budget

September 27: FY2023 Operating and CIP Budget and Tax Rate Adoption

· City Council considers FY2023 Annual Budget and Five-Year Capital Improvement Program for adoption

· Public hearing on the tax rate

· City Council adopts tax rate for FY2023

· Action establishes split between operating/debt service tax rates

November: Adopted Operating Budget & 5-Year Capital Improvement Program

Published

· Fiscal Year 2023 Adopted Operating Budget Book is published

· Fiscal Year 2023-2027 5-Year CIP is published

December 2022 – January 2023: Year-end Finalization of FY2022

· Verify all transactions have been completed for FY2022 for both Operating and Capital funds

· Confirm all M&C’s have been completed and processed for FY2022

· Executive level Year-End Financial review and address any concerns/provide feedback

Page 40 of 623