Page 256 - FortWorthFY23AdoptedBudget

P. 256

Special Project Funds

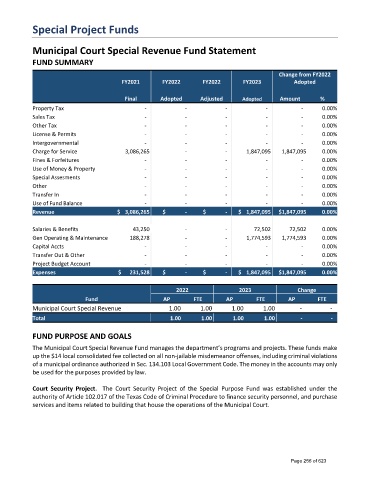

Municipal Court Special Revenue Fund Statement

FUND SUMMARY

Change from FY2022

FY2021 FY2022 FY2022 FY2023 Adopted

Final Adopted Adjusted Adopted Amount %

Property Tax - - - - - 0.00%

Sales Tax - - - - - 0.00%

Other Tax - - - - - 0.00%

License & Permits - - - - - 0.00%

Intergovernmental - - - - - 0.00%

Charge for Service 3,086,265 - - 1,847,095 1,847,095 0.00%

Fines & Forfeitures - - - - - 0.00%

Use of Money & Property - - - - - 0.00%

Special Assesments - - - - - 0.00%

Other - - - - - 0.00%

Transfer In - - - - - 0.00%

Use of Fund Balance - - - - - 0.00%

Revenue $ 3,086,265 $ - $ - $ 1,847,095 $1,847,095 0.00%

Salaries & Benefits 43,250 - - 72,502 72,502 0.00%

Gen Operating & Maintenance 188,278 - - 1,774,593 1,774,593 0.00%

Capital Accts - - - - - 0.00%

Transfer Out & Other - - - - - 0.00%

Project Budget Account - - - - - 0.00%

Expenses $ 231,528 $ - $ - $ 1,847,095 $1,847,095 0.00%

2022 2023 Change

Fund AP FTE AP FTE AP FTE

Municipal Court Special Revenue 1.00 1.00 1.00 1.00 - -

Total 1.00 1.00 1.00 1.00 - -

FUND PURPOSE AND GOALS

The Municipal Court Special Revenue Fund manages the department’s programs and projects. These funds make

up the $14 local consolidated fee collected on all non-jailable misdemeanor offenses, including criminal violations

of a municipal ordinance authorized in Sec. 134.103 Local Government Code. The money in the accounts may only

be used for the purposes provided by law.

Court Security Project. The Court Security Project of the Special Purpose Fund was established under the

authority of Article 102.017 of the Texas Code of Criminal Procedure to finance security personnel, and purchase

services and items related to building that house the operations of the Municipal Court.

Page 256 of 623