Page 189 - FortWorthFY23AdoptedBudget

P. 189

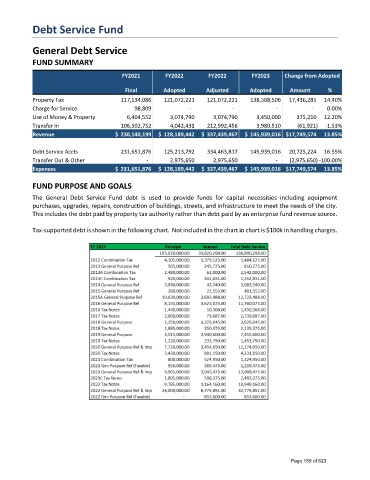

Debt Service Fund

General Debt Service

FUND SUMMARY

FY2021 FY2022 FY2022 FY2023 Change from Adopted

Final Adopted Adjusted Adopted Amount %

Property Tax 117,134,086 121,072,221 121,072,221 138,508,506 17,436,285 14.40%

Charge for Service 98,809 - - - - 0.00%

Use of Money & Property 6,404,552 3,074,790 3,074,790 3,450,000 375,210 12.20%

Transfer In 106,502,752 4,042,431 212,992,456 3,980,510 (61,921) -1.53%

Revenue $ 230,140,199 $ 128,189,442 $ 337,439,467 $ 145,939,016 $17,749,574 13.85%

Debt Service Accts 231,651,876 125,213,792 334,463,817 145,939,016 20,725,224 16.55%

Transfer Out & Other - 2,975,650 2,975,650 - (2,975,650) -100.00%

Expenses $ 231,651,876 $ 128,189,442 $ 337,439,467 $ 145,939,016 $17,749,574 13.85%

FUND PURPOSE AND GOALS

The General Debt Service Fund debt is used to provide funds for capital necessities including equipment

purchases, upgrades, repairs, construction of buildings, streets, and infrastructure to meet the needs of the city.

This includes the debt paid by property tax authority rather than debt paid by an enterprise fund revenue source.

Tax-supported debt is shown in the following chart. Not included in the chart in chart is $100k in handling charges.

Page 189 of 623