Page 323 - FY 22-23 Budget Book - For Website_202303071553082457.pdf

P. 323

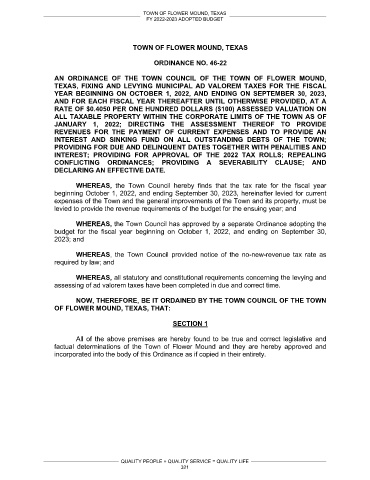

TOWN OF FLOWER MOUND, TEXAS

ORDINANCE NO. 46-22

AN ORDINANCE OF THE TOWN COUNCIL OF THE TOWN OF FLOWER MOUND,

TEXAS, FIXING AND LEVYING MUNICIPAL AD VALOREM TAXES FOR THE FISCAL

YEAR BEGINNING ON OCTOBER 1, 2022, AND ENDING ON SEPTEMBER 30, 2023,

AND FOR EACH FISCAL YEAR THEREAFTER UNTIL OTHERWISE PROVIDED, AT A

RATE OF $0.4050 PER ONE HUNDRED DOLLARS ($100) ASSESSED VALUATION ON

ALL TAXABLE PROPERTY WITHIN THE CORPORATE LIMITS OF THE TOWN AS OF

JANUARY 1, 2022; DIRECTING THE ASSESSMENT THEREOF TO PROVIDE

REVENUES FOR THE PAYMENT OF CURRENT EXPENSES AND TO PROVIDE AN

INTEREST AND SINKING FUND ON ALL OUTSTANDING DEBTS OF THE TOWN;

PROVIDING FOR DUE AND DELINQUENT DATES TOGETHER WITH PENALITIES AND

INTEREST; PROVIDING FOR APPROVAL OF THE 2022 TAX ROLLS; REPEALING

CONFLICTING ORDINANCES; PROVIDING A SEVERABILITY CLAUSE; AND

DECLARING AN EFFECTIVE DATE.

WHEREAS,

WHEREAS,

WHEREAS

WHEREAS,

NOW, THEREFORE, BE IT ORDAINED BY THE TOWN COUNCIL OF THE TOWN

OF FLOWER MOUND, TEXAS, THAT:

SECTION 1