Page 2 - FY 22-23 Budget Book - For Website_202303071553082457.pdf

P. 2

Filed 03/29/2024 11:18 AM

Tarrant County Clerk's Office

Mary Louise Nicholson,

Town of Flower Mound County Clerk

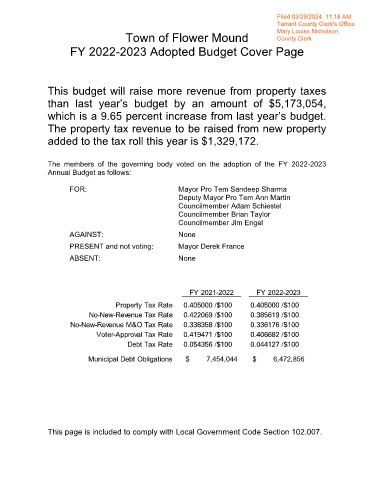

FY 2022-2023 Adopted Budget Cover Page

This budget will raise more revenue from property taxes

than last amount of $5,173,054,

which is a 9.65 percent increase

The property tax revenue to be raised from new property

added to the tax roll this year is $1,329,172.

The members of the governing body voted on the adoption of the FY 2022-2023

Annual Budget as follows:

FOR: Mayor Pro Tem Sandeep Sharma

Deputy Mayor Pro Tem Ann Martin

Councilmember Adam Schiestel

Councilmember Brian Taylor

Councilmember Jim Engel

AGAINST: None

PRESENT and not voting: Mayor Derek France

ABSENT: None

FY 2021-2022 FY 2022-2023

Property Tax Rate

No-New-Revenue TaxRate

No-New-Revenue M&O Tax Rate

Voter-Approval Tax Rate

Debt Tax Rate

MunicipalDebt Obligations $ 7,454,044 $ 6,472,856

This page is included to comply with Local Government Code Section 102.007.