Page 102 - CityofColleyvilleFY23AdoptedBudget

P. 102

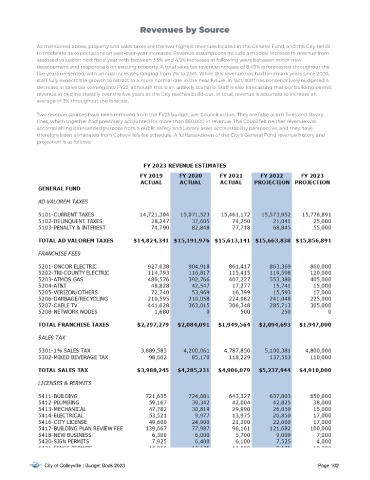

Revenues by Source

As mentioned above, property and sales taxes are the two highest revenues located in the General Fund, and the City tends

to moderate its expectations on year-over-year increases. Revenue assumptions include a modest increase in revenue from

assessed valuation next scal year with between 3.5% and 4.5% increases in following years between minor new

development and reappraisals on existing property. A total sales tax revenue increase of 8.49% is forecasted throughout the

ve years presented, with annual increases ranging from 2% to 2.5%. While this revenue has had landmark years since 2020,

staff fully expects the growth to retract to a more normal rate in the near future. In fact, staff has conservatively budgeted a

decrease in sales tax coming into FY23, although this is an unlikely scenario. Staff is also forecasting that our building permit

revenue to decline steadily over the ve years as the City reaches build-out. In total, revenue is assumed to increase an

average of 3% throughout the forecast.

Two revenue sources have been removed from the FY23 budget, per Council action. They are false alarm nes and library

nes, which together had previously accounted for more than $60,000 in revenue. The Coucil felt neither revenue was

accomplishing its intended purpose from a public safety and Library asset accountability perspective, and they have

therefore been eliminated from Colleyville's fee schedule. A full breakdown of the City's General Fund revenue history and

projection is as follows:

City of Colleyville | Budget Book 2023 Page 102