Page 561 - Bedford-FY22-23 Budget

P. 561

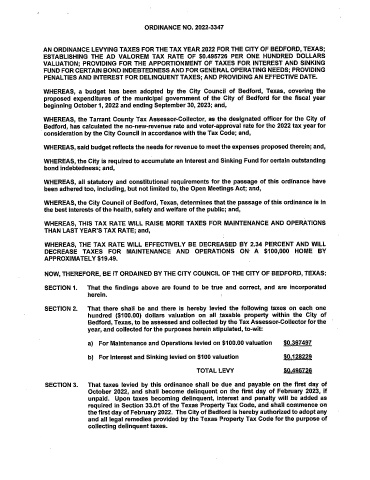

ORDINANCE NO. 2022-3347

AN ORDINANCE LEVYING TAXES FOR THE TAX YEAR 2022 FOR THE CITY OF BEDFORD, TEXAS;

495726

ESTABLISHING THE AD VALOREM TAX RATE OF $ 0. PER ONE HUNDRED DOLLARS

VALUATION; PROVIDING FOR THE APPORTIONMENT OF TAXES FOR INTEREST AND SINKING

FUND FOR CERTAIN BOND INDEBTEDNESS AND FOR GENERAL OPERATING NEEDS; PROVIDING

PENALTIES AND INTEREST FOR DELINQUENT TAXES; AND PROVIDING AN EFFECTIVE DATE.

WHEREAS, a budget has been adopted by the City Council of Bedford, Texas, covering the

proposed expenditures of the municipal government of the City of Bedford for the fiscal year

beginning October 1, 2022 and ending September 30, 2023; and,

WHEREAS, the Tarrant County Tax Assessor - Collector, as the designated officer for the City of

Bedford, has calculated the no -new -revenue rate and voter - approval rate for the 2022 tax year for

consideration by the City Council in accordance with the Tax Code; and,

WHEREAS, said budget reflects the needs for revenue to meet the expenses proposed therein; and,

WHEREAS, the City is required to accumulate an Interest and Sinking Fund for certain outstanding

bond indebtedness; and,

WHEREAS, all statutory and constitutional requirements for the passage of this ordinance have

been adhered too, including, but not limited to, the Open Meetings Act; and,

WHEREAS, the City Council of Bedford, Texas, determines that the passage of this ordinance is in

the best interests of the health, safety and welfare of the public; and,

WHEREAS, THIS TAX RATE WILL RAISE MORE TAXES FOR MAINTENANCE AND OPERATIONS

THAN LAST YEAR'S TAX RATE; and,

34 PERCENT AND WILL

WHEREAS, THE TAX RATE WILL EFFECTIVELY BE DECREASED BY 2.

DECREASE TAXES FOR MAINTENANCE AND OPERATIONS ON. A $ 100,000 HOME BY

APPROXIMATELY $ 19.49.

NOW, THEREFORE, BE IT ORDAINED BY THE CITY COUNCIL OF THE CITY OF BEDFORD, TEXAS:

SECTION 1. That the findings above are found to be true and correct, and are incorporated

herein.

SECTION 2. That there shall be and there is hereby levied the following taxes on each one

00)

hundred ($ 100. dollars valuation on all , taxable property within the City of

Bedford, Texas, to be assessed and collected by the Tax Assessor - Collector for the

year, and collected for the purposes herein stipulated, to -wit:

0.

a) For Maintenance and Operations levied on $ 100.00 valuation $ 367497

0.

b) For Interest and Sinking levied on $ 100 valuation $ 128229

495726

TOTAL LEVY $ 0.

SECTION 3. That taxes levied by this ordinance shall be due and payable on the first day of

October 2022, and shall become delinquent on the first day of February 2023, if

unpaid. Upon taxes becoming delinquent, interest and penalty will be added as

required in Section 33.01 of the Texas Property Tax Code, and shall commence on

the first day of February 2022. The City of Bedford is hereby authorized to adopt any

and all legal remedies provided by the Texas Property Tax Code for the purpose of

collecting delinquent taxes.