Page 209 - Bedford-FY22-23 Budget

P. 209

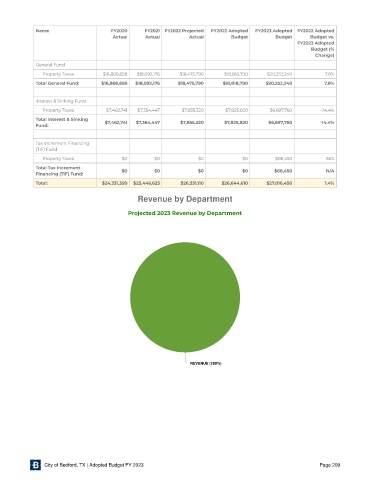

Name FY2020 FY2021 FY2022 Projected FY2022 Adopted FY2023 Adopted FY2022 Adopted

Actual Actual Actual Budget Budget Budget vs.

FY2023 Adopted

Budget (%

Change)

General Fund

Property Taxes $16,868,658 $18,092,176 $18,475,790 $18,818,790 $20,252,240 7.6%

Total General Fund: $16,868,658 $18,092,176 $18,475,790 $18,818,790 $20,252,240 7.6%

Interest & Sinking Fund

Property Taxes $7,462,741 $7,354,447 $7,855,320 $7,825,820 $6,697,760 -14.4%

Total Interest & Sinking

$7,462,741 $7,354,447 $7,855,320 $7,825,820 $6,697,760 -14.4%

Fund:

Tax Increment Financing

(TIF) Fund

Property Taxes $0 $0 $0 $0 $66,450 N/A

Total Tax Increment

$0 $0 $0 $0 $66,450 N/A

Financing (TIF) Fund:

Total: $24,331,399 $25,446,623 $26,331,110 $26,644,610 $27,016,450 1.4%

Revenue by Department

Projected 2023 Revenue by Depar tment

1

1

(

(

0

%

%

0

0

0

V

V

E

R R REVENUE (100%) ) )

E

E

E

U

E

E

N

N

U

City of Bedford, TX | Adopted Budget FY 2023 Page 209