Page 25 - CITY OF AZLE, TEXAS

P. 25

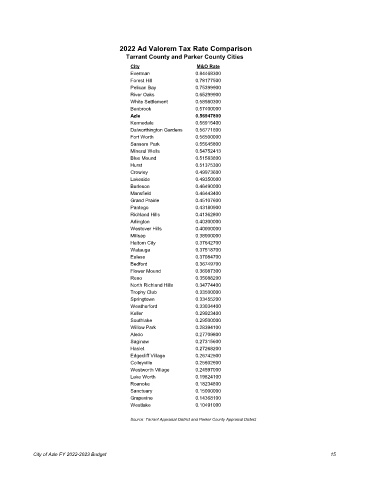

2022 Ad Valorem Tax Rate Comparison

Tarrant County and Parker County Cities

City M&O Rate

Everman 0.84468300

Forest Hill 0.78177500

Pelican Bay 0.75399900

River Oaks 0.65299900

White Settlement 0.58980300

Benbrook 0.57400000

Azle 0.56947800

Kennedale 0.56915400

Dalworthington Gardens 0.56771600

Fort Worth 0.56500000

Sansom Park 0.55645800

Mineral Wells 0.54752413

Blue Mound 0.51583800

Hurst 0.51375300

Crowley 0.49973600

Lakeside 0.49350000

Burleson 0.46490000

Mansfield 0.46443400

Grand Prairie 0.45107600

Pantego 0.43180900

Richland Hills 0.41362800

Arlington 0.40300000

Westover Hills 0.40000000

Millsap 0.38000000

Haltom City 0.37642700

Watauga 0.37518700

Euless 0.37084700

Bedford 0.36749700

Flower Mound 0.36087300

Reno 0.35088200

North Richland Hills 0.34774400

Trophy Club 0.33500000

Springtown 0.33455200

Weatherford 0.33034400

Keller 0.29923400

Southlake 0.29500000

Willow Park 0.28394100

Aledo 0.27709800

Saginaw 0.27315600

Haslet 0.27268200

Edgecliff Village 0.26742500

Colleyville 0.25602600

Westworth Village 0.24597000

Lake Worth 0.19824100

Roanoke 0.18234800

Sanctuary 0.15000000

Grapevine 0.14368100

Westlake 0.10491000

Source: Tarrant Appraisal District and Parker County Appraisal District

City of Azle FY 2022-2023 Budget 15