Page 36 - City of Westworth Village FY22 Budget

P. 36

36

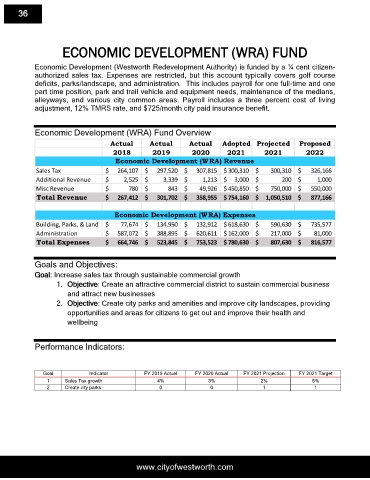

ECONOMIC DEVELOPMENT (WRA) FUND

Economic Development (Westworth Redevelopment Authority) is funded by a ¼ cent citizen-

authorized sales tax. Expenses are restricted, but this account typically covers golf course

deficits, parks/landscape, and administration. This includes payroll for one full-time and one

part time position, park and trail vehicle and equipment needs, maintenance of the medians,

alleyways, and various city common areas. Payroll includes a three percent cost of living

adjustment, 12% TMRS rate, and $725/month city paid insurance benefit.

Economic Development (WRA) Fund Overview

Actual Actual Actual Adopted Projected Proposed

2018 2019 2020 2021 2021 2022

Economic Development (WRA) Revenue

Sales Tax $ 264,107 $ 297,520 $ 307,815 $ 300,310 $ 300,310 $ 326,166

Additional Revenue $ 2,525 $ 3,339 $ 1,213 $ 3,000 $ 200 $ 1,000

Misc Revenue $ 780 $ 843 $ 49,926 $ 450,850 $ 750,000 $ 550,000

Total Revenue $ 267,412 $ 301,702 $ 358,955 $ 754,160 $ 1,050,510 $ 877,166

Economic Development (WRA) Expenses

Building, Parks, & Land $ 77,674 $ 134,950 $ 132,912 $ 618,630 $ 590,630 $ 735,577

Administration $ 587,072 $ 388,895 $ 620,611 $ 162,000 $ 217,000 $ 81,000

Total Expenses $ 664,746 $ 523,845 $ 753,523 $ 780,630 $ 807,630 $ 816,577

Goals and Objectives:

Goal: Increase sales tax through sustainable commercial growth

1. Objective: Create an attractive commercial district to sustain commercial business

and attract new businesses

2. Objective: Create city parks and amenities and improve city landscapes, providing

opportunities and areas for citizens to get out and improve their health and

wellbeing

Performance Indicators:

Goal Indicator FY 2019 Actual FY 2020 Actual FY 2021 Projection FY 2021 Target

1 Sales Tax growth 4% 3% 2% 5%

2 Create city parks 0 0 1 1

www.cityofwestworth.com