Page 65 - PowerPoint Presentation

P. 65

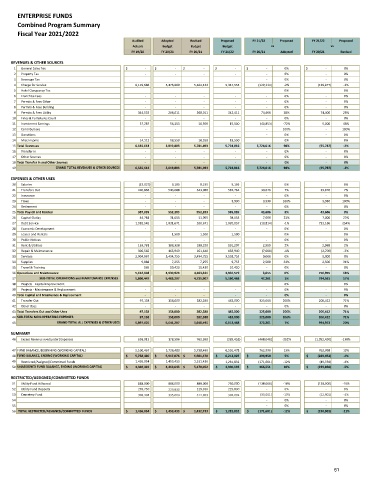

ENTERPRISE FUNDS

Combined Program Summary

Fiscal Year 2021/2022

Audited Adopted Revised Proposed FY 21/22 Proposed FY 21/22 Proposed

Actuals Budget Budget Budget vs vs

FY 19/20 FY 20/21 FY 20/21 FY 21/22 FY 20/21 Adopted FY 20/21 Revised

REVENUES & OTHER SOURCES

1 General Sales Tax $ - $ - $ - $ - $ - 0% $ - 0%

2 Property Tax - - - - - 0% - 0%

3 Beverage Tax - 0% - 0%

4 Charge for Service 6,119,686 5,476,889 5,484,432 5,347,555 (129,334) -2% (136,877) -2%

5 Hotel Occupancy Tax - - - - - 0% - 0%

6 Franchise Fees - - - - - 0% - 0%

7 Permits & Fees Other - - - - - 0% - 0%

8 Permits & Fees Building - - - - - 0% - 0%

9 Permits & Fees Utility 344,533 268,011 268,011 342,411 74,400 28% 74,400 28%

10 Fines & Forfeitures Court - - - - - 0% - 0%

11 Investment Earnings 57,287 56,353 10,500 15,500 (40,853) -72% 5,000 48%

12 Contributions - - - - - 100% - 100%

13 Donations - 0% - 0%

14 Misc Income 14,112 18,550 18,550 18,550 - 0% - 0%

15 Total Revenues 6,535,618 5,819,803 5,781,493 5,724,016 5,724,016 98% (95,787) -2%

16 Transfer In - - - - - 0% - 0%

17 Other Sources - - - - - 0% - 0%

18 Total Transfer In and Other Sources - - - - - 0% - 0%

19 GRAND TOTAL REVENUES & OTHER SOURCES 6,535,618 5,819,803 5,781,493 5,724,016 5,724,016 98% (95,787) -2%

EXPENSES & OTHER USES

20 Salaries (23,027) 9,195 9,195 9,195 - 0% - 0%

21 Transfers Out 410,866 543,088 543,088 582,764 39,676 7% 39,676 7%

22 Insurance - - - - - 0% - 0%

23 Taxes - - - 3,930 3,930 100% 3,930 100%

24 Retirement - - - - - 0% - 0%

25 Total Payroll and Related 387,839 552,283 552,283 595,889 43,606 8% 43,606 8%

26 Capital Outlay 44,781 31,055 31,055 38,055 7,000 23% 7,000 23%

27 Debt Service 1,982,542 1,031,671 288,671 1,020,857 (10,814) -1% 732,186 254%

28 Economic Development - - - - - 0% - 0%

29 Leases and Rentals - 1,500 1,500 1,500 - 0% - 0%

30 Public Notices - - - - - 0% - 0%

31 Rent & Utilities 163,781 188,328 188,328 191,297 2,969 2% 2,969 2%

32 Repair & Maintenance 306,565 165,940 161,640 158,940 (7,000) -4% (2,700) -2%

33 Services 2,904,887 3,494,755 3,494,755 3,503,755 9,000 0% 9,000 0%

34 Supplies 9,888 7,255 7,255 9,755 2,500 34% 2,500 34%

35 Travel & Training 165 10,420 10,420 10,420 - 0% - 0%

36 Operations and Maintenance 5,412,608 4,930,924 4,183,624 4,934,579 3,655 0% 750,955 18%

37 SUB-TOTAL OPERATIONS and MAINTENANCE EXPENSES 5,800,447 5,483,207 4,735,907 5,530,468 47,261 1% 794,561 17%

38 Projects - Capital improvement - - - - - 0% - 0%

39 Projects - Maintenance & Replacement - - - - - 0% - 0%

40 Total Capital and Mainteance & Replacement - - - - - 0% - 0%

41 Transfer Out 97,158 158,000 282,588 483,000 325,000 206% 200,412 71%

42 Other Uses - - - - - 0% - 0%

43 Total Transfers Out and Other Uses 97,158 158,000 282,588 483,000 325,000 206% 200,412 71%

44 SUB-TOTAL NON-OPERATING EXPENSES 97,158 158,000 282,588 483,000 325,000 206% 200,412 71%

45 GRAND TOTAL ALL EXPENSES & OTHER USES 5,897,605 5,641,207 5,018,495 6,013,468 372,261 7% 994,973 20%

SUMMARY

46 Excess Revenus over(under) Expenses 638,013 178,596 762,998 (289,452) (468,048) -262% (1,052,450) -138%

47 FUND BALANCE, BEGINNING (WORKING CAPITAL) 5,100,467 5,738,480 5,738,480 6,501,478 762,998 13% 762,998 13%

48 FUND BALANCE, ENDING (WORKING CAPITAL) $ 5,738,480 $ 5,917,076 $ 6,501,478 $ 6,212,025 $ 294,950 5% $ (289,452) -4%

49 Restricted/Assigned/Committed Funds 1,436,054 1,453,433 1,331,426 1,281,832 (171,601) -12% (49,594) -4%

50 UNASSIGNED FUND BALANCE, ENDING (WORKING CAPITAL) $ 4,302,426 $ 4,463,643 $ 5,170,052 $ 4,930,193 $ 466,551 10% $ (239,858) -5%

RESTRICTED/ASSIGNED/COMMITTED FUNDS

51 Utility Fund Hillwood 888,000 888,000 888,000 750,000 (138,000) -16% (138,000) -16%

52 Utility Fund Deposits 239,750 229,830 229,830 229,830 - 0% - 0%

53 Cemetery Fund 308,304 335,603 314,903 302,002 (33,601) -10% (12,901) -4%

54 - 0% - 0%

55 - 0% - 0%

56 TOTAL RESTRICTED/ASSIGNED/COMMITTED FUNDS $ 1,436,054 $ 1,453,433 $ 1,432,733 $ 1,281,832 $ (171,601) -12% $ (150,901) -11%

61