Page 170 - PowerPoint Presentation

P. 170

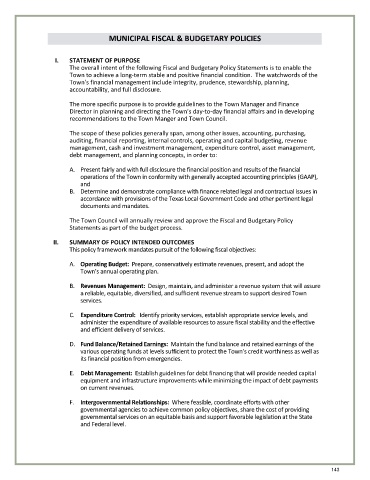

MUNICIPAL FISCAL & BUDGETARY POLICIES

I. STATEMENT OF PURPOSE

The overall intent of the following Fiscal and Budgetary Policy Statements is to enable the

Town to achieve a long-term stable and positive financial condition. The watchwords of the

Town’s financial management include integrity, prudence, stewardship, planning,

accountability, and full disclosure.

The more specific purpose is to provide guidelines to the Town Manager and Finance

Director in planning and directing the Town’s day-to-day financial affairs and in developing

recommendations to the Town Manger and Town Council.

The scope of these policies generally span, among other issues, accounting, purchasing,

auditing, financial reporting, internal controls, operating and capital budgeting, revenue

management, cash and investment management, expenditure control, asset management,

debt management, and planning concepts, in order to:

A. Present fairly and with full disclosure the financial position and results of the financial

operations of the Town in conformity with generally accepted accounting principles (GAAP),

and

B. Determine and demonstrate compliance with finance related legal and contractual issues in

accordance with provisions of the Texas Local Government Code and other pertinent legal

documents and mandates.

The Town Council will annually review and approve the Fiscal and Budgetary Policy

Statements as part of the budget process.

II. SUMMARY OF POLICY INTENDED OUTCOMES

This policy framework mandates pursuit of the following fiscal objectives:

A. Operating Budget: Prepare, conservatively estimate revenues, present, and adopt the

Town’s annual operating plan.

B. Revenues Management: Design, maintain, and administer a revenue system that will assure

a reliable, equitable, diversified, and sufficient revenue stream to support desired Town

services.

C. Expenditure Control: Identify priority services, establish appropriate service levels, and

administer the expenditure of available resources to assure fiscal stability and the effective

and efficient delivery of services.

D. Fund Balance/Retained Earnings: Maintain the fund balance and retained earnings of the

various operating funds at levels sufficient to protect the Town’s credit worthiness as well as

its financial position from emergencies.

E. Debt Management: Establish guidelines for debt financing that will provide needed capital

equipment and infrastructure improvements while minimizing the impact of debt payments

on current revenues.

F. Intergovernmental Relationships: Where feasible, coordinate efforts with other

governmental agencies to achieve common policy objectives, share the cost of providing

governmental services on an equitable basis and support favorable legislation at the State

and Federal level.

143