Page 123 - PowerPoint Presentation

P. 123

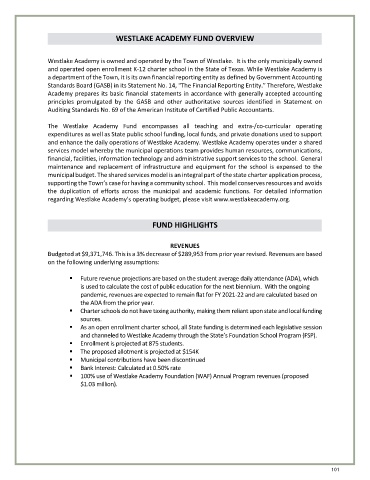

WESTLAKE ACADEMY FUND OVERVIEW

Westlake Academy is owned and operated by the Town of Westlake. It is the only municipally owned

and operated open enrollment K-12 charter school in the State of Texas. While Westlake Academy is

a department of the Town, it is its own financial reporting entity as defined by Government Accounting

Standards Board (GASB) in its Statement No. 14, “The Financial Reporting Entity.” Therefore, Westlake

Academy prepares its basic financial statements in accordance with generally accepted accounting

principles promulgated by the GASB and other authoritative sources identified in Statement on

Auditing Standards No. 69 of the American Institute of Certified Public Accountants.

The Westlake Academy Fund encompasses all teaching and extra-/co-curricular operating

expenditures as well as State public school funding, local funds, and private donations used to support

and enhance the daily operations of Westlake Academy. Westlake Academy operates under a shared

services model whereby the municipal operations team provides human resources, communications,

financial, facilities, information technology and administrative support services to the school. General

maintenance and replacement of infrastructure and equipment for the school is expensed to the

municipal budget. The shared services model is an integral part of the state charter application process,

supporting the Town’s case for having a community school. This model conserves resources and avoids

the duplication of efforts across the municipal and academic functions. For detailed information

regarding Westlake Academy’s operating budget, please visit www.westlakeacademy.org.

FUND HIGHLIGHTS

REVENUES

Budgeted at $9,371,746. This is a 3% decrease of $289,953 from prior year revised. Revenues are based

on the following underlying assumptions:

Future revenue projections are based on the student average daily attendance (ADA), which

is used to calculate the cost of public education for the next biennium. With the ongoing

pandemic, revenues are expected to remain flat for FY 2021-22 and are calculated based on

the ADA from the prior year.

Charter schools do not have taxing authority, making them reliant upon state and local funding

sources.

As an open enrollment charter school, all State funding is determined each legislative session

and channeled to Westlake Academy through the State’s Foundation School Program (FSP).

Enrollment is projected at 875 students.

The proposed allotment is projected at $154K

Municipal contributions have been discontinued

Bank Interest: Calculated at 0.50% rate

100% use of Westlake Academy Foundation (WAF) Annual Program revenues (proposed

$1.03 million).

101