Page 336 - City of Watauga FY22 Adopted Budget

P. 336

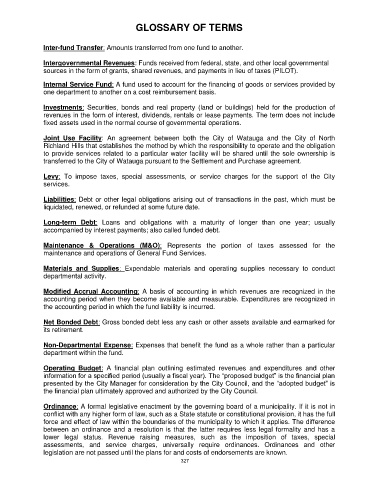

GLOSSARY OF TERMS

Inter-fund Transfer: Amounts transferred from one fund to another.

Intergovernmental Revenues: Funds received from federal, state, and other local governmental

sources in the form of grants, shared revenues, and payments in lieu of taxes (PILOT).

Internal Service Fund: A fund used to account for the financing of goods or services provided by

one department to another on a cost reimbursement basis.

Investments: Securities, bonds and real property (land or buildings) held for the production of

revenues in the form of interest, dividends, rentals or lease payments. The term does not include

fixed assets used in the normal course of governmental operations.

Joint Use Facility: An agreement between both the City of Watauga and the City of North

Richland Hills that establishes the method by which the responsibility to operate and the obligation

to provide services related to a particular water facility will be shared until the sole ownership is

transferred to the City of Watauga pursuant to the Settlement and Purchase agreement.

Levy: To impose taxes, special assessments, or service charges for the support of the City

services.

Liabilities: Debt or other legal obligations arising out of transactions in the past, which must be

liquidated, renewed, or refunded at some future date.

Long-term Debt: Loans and obligations with a maturity of longer than one year; usually

accompanied by interest payments; also called funded debt.

Maintenance & Operations (M&O): Represents the portion of taxes assessed for the

maintenance and operations of General Fund Services.

Materials and Supplies: Expendable materials and operating supplies necessary to conduct

departmental activity.

Modified Accrual Accounting: A basis of accounting in which revenues are recognized in the

accounting period when they become available and measurable. Expenditures are recognized in

the accounting period in which the fund liability is incurred.

Net Bonded Debt: Gross bonded debt less any cash or other assets available and earmarked for

its retirement.

Non-Departmental Expense: Expenses that benefit the fund as a whole rather than a particular

department within the fund.

Operating Budget: A financial plan outlining estimated revenues and expenditures and other

information for a specified period (usually a fiscal year). The “proposed budget” is the financial plan

presented by the City Manager for consideration by the City Council, and the “adopted budget” is

the financial plan ultimately approved and authorized by the City Council.

Ordinance: A formal legislative enactment by the governing board of a municipality. If it is not in

conflict with any higher form of law, such as a State statute or constitutional provision, it has the full

force and effect of law within the boundaries of the municipality to which it applies. The difference

between an ordinance and a resolution is that the latter requires less legal formality and has a

lower legal status. Revenue raising measures, such as the imposition of taxes, special

assessments, and service charges, universally require ordinances. Ordinances and other

legislation are not passed until the plans for and costs of endorsements are known.

327