Page 238 - City of Watauga FY22 Adopted Budget

P. 238

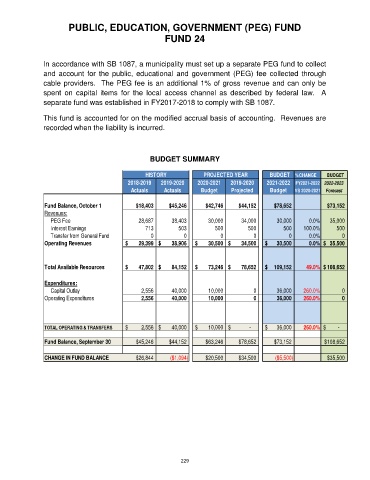

PUBLIC, EDUCATION, GOVERNMENT (PEG) FUND

FUND 24

In accordance with SB 1087, a municipality must set up a separate PEG fund to collect

and account for the public, educational and government (PEG) fee collected through

cable providers. The PEG fee is an additional 1% of gross revenue and can only be

spent on capital items for the local access channel as described by federal law. A

separate fund was established in FY2017-2018 to comply with SB 1087.

This fund is accounted for on the modified accrual basis of accounting. Revenues are

recorded when the liability is incurred.

BUDGET SUMMARY

HISTORY PROJECTED YEAR BUDGET %CHANGE BUDGET

2018-2019 2019-2020 2020-2021 2019-2020 2021-2022 FY2021-2022 2022-2023

Actuals Actuals Budget Projected Budget VS 2020-2021 Forecast

Fund Balance, October 1 $18,403 $45,246 $42,746 $44,152 $78,652 $73,152

Revenues:

PEG Fee 28,687 38,403 30,000 34,000 30,000 0.0% 35,000

Interest Earnings 713 503 500 500 500 100.0% 500

Transfer from General Fund 0 0 0 0 0 0.0% 0

Operating Revenues $ 29,399 $ 38,906 $ 30,500 $ 34,500 $ 30,500 0.0% $ 35,500

Total Available Resources $ 47,802 $ 84,152 $ 73,246 $ 78,652 $ 109,152 49.0% $ 108,652

Expenditures:

Capital Outlay 2,556 40,000 10,000 0 36,000 260.0% 0

Operating Expenditures 2,556 40,000 10,000 0 36,000 260.0% 0

TOTAL OPERATING & TRANSFERS $ 2,556 $ 40,000 $ 10,000 $ - $ 36,000 260.0% $ -

Fund Balance, September 30 $45,246 $44,152 $63,246 $78,652 $73,152 $108,652

CHANGE IN FUND BALANCE $26,844 ($1,094) $20,500 $34,500 ($5,500) $35,500

229