Page 2 - City of Watauga FY22 Adopted Budget

P. 2

City of Watauga

Fiscal Year 2021-2022

Budget Cover Page

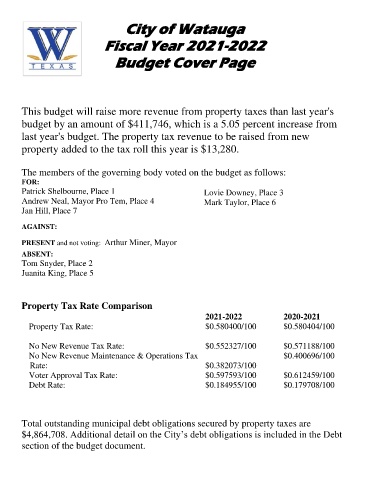

This budget will raise more revenue from property taxes than last year's

budget by an amount of $411,746, which is a 5.05 percent increase from

last year's budget. The property tax revenue to be raised from new

property added to the tax roll this year is $13,280.

The members of the governing body voted on the budget as follows:

FOR:

Patrick Shelbourne, Place 1 Lovie Downey, Place 3

Andrew Neal, Mayor Pro Tem, Place 4 Mark Taylor, Place 6

Jan Hill, Place 7

AGAINST:

PRESENT and not voting: Arthur Miner, Mayor

ABSENT:

Tom Snyder, Place 2

Juanita King, Place 5

Property Tax Rate Comparison

2021-2022 2020-2021

Property Tax Rate: $0.580400/100 $0.580404/100

No New Revenue Tax Rate: $0.552327/100 $0.571188/100

No New Revenue Maintenance & Operations Tax $0.400696/100

Rate: $0.382073/100

Voter Approval Tax Rate: $0.597593/100 $0.612459/100

Debt Rate: $0.184955/100 $0.179708/100

Total outstanding municipal debt obligations secured by property taxes are

$4,864,708. Additional detail on the City’s debt obligations is included in the Debt

section of the budget document.