Page 63 - Trophy Club FY22 Budget

P. 63

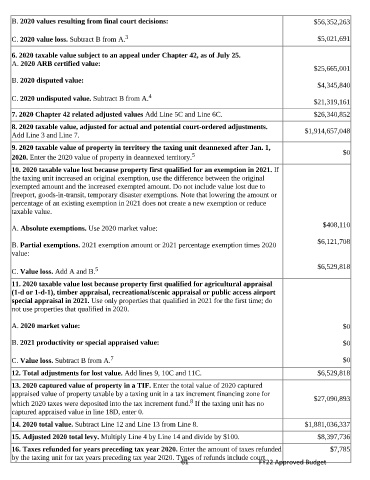

B. 2020 values resulting from final court decisions: $56,352,263

3

C. 2020 value loss. Subtract B from A. $5,021,691

6. 2020 taxable value subject to an appeal under Chapter 42, as of July 25.

A. 2020 ARB certified value:

$25,665,001

B. 2020 disputed value:

$4,345,840

4

C. 2020 undisputed value. Subtract B from A.

$21,319,161

7. 2020 Chapter 42 related adjusted values Add Line 5C and Line 6C. $26,340,852

8. 2020 taxable value, adjusted for actual and potential court-ordered adjustments. $1,914,657,048

Add Line 3 and Line 7.

9. 2020 taxable value of property in territory the taxing unit deannexed after Jan. 1, $0

2020. Enter the 2020 value of property in deannexed territory. 5

10. 2020 taxable value lost because property first qualified for an exemption in 2021. If

the taxing unit increased an original exemption, use the difference between the original

exempted amount and the increased exempted amount. Do not include value lost due to

freeport, goods-in-transit, temporary disaster exemptions. Note that lowering the amount or

percentage of an existing exemption in 2021 does not create a new exemption or reduce

taxable value.

$408,110

A. Absolute exemptions. Use 2020 market value:

B. Partial exemptions. 2021 exemption amount or 2021 percentage exemption times 2020 $6,121,708

value:

$6,529,818

C. Value loss. Add A and B. 5

11. 2020 taxable value lost because property first qualified for agricultural appraisal

(1-d or 1-d-1), timber appraisal, recreational/scenic appraisal or public access airport

special appraisal in 2021. Use only properties that qualified in 2021 for the first time; do

not use properties that qualified in 2020.

A. 2020 market value: $0

B. 2021 productivity or special appraised value: $0

C. Value loss. Subtract B from A. 7 $0

12. Total adjustments for lost value. Add lines 9, 10C and 11C. $6,529,818

13. 2020 captured value of property in a TIF. Enter the total value of 2020 captured

appraised value of property taxable by a taxing unit in a tax increment financing zone for $27,090,893

8

which 2020 taxes were deposited into the tax increment fund. If the taxing unit has no

captured appraised value in line 18D, enter 0.

14. 2020 total value. Subtract Line 12 and Line 13 from Line 8. $1,881,036,337

15. Adjusted 2020 total levy. Multiply Line 4 by Line 14 and divide by $100. $8,397,736

16. Taxes refunded for years preceding tax year 2020. Enter the amount of taxes refunded $7,785

by the taxing unit for tax years preceding tax year 2020. Types of refunds include court

61 FY22 Approved Budget