Page 350 - Southlake FY22 Budget

P. 350

SPECIAL rEVEnUE FUnDS EXPEnDITUrES

SALES TAX DISTrICTS

southlake Parks deVeloPment corPoration (sPdc) Fund

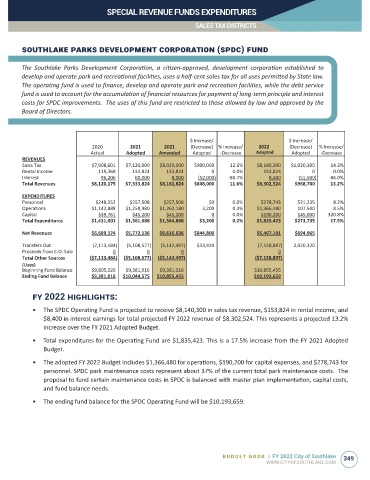

The Southlake Parks Development Corporation, a citizen-approved, development corporation established to

develop and operate park and recreational facilities, uses a half-cent sales tax for all uses permitted by State law.

The operating fund is used to finance, develop and operate park and recreation facilities, while the debt service

fund is used to account for the accumulation of financial resources for payment of long-term principle and interest

costs for SPDC improvements. The uses of this fund are restricted to those allowed by law and approved by the

SPDC - OPERATING FUND

Board of Directors. Parks/Recreation

2022 Proposed and 2021 Revised Budget

04:13 PM

07/21/21

$ Increase/ $ Increase/

2020 2021 2021 (Decrease) % Increase/ 2022 (Decrease) % Increase/

Actual Adopted Amended Adopted -Decrease Proposed Adopted -Decrease

Adopted

REVENUES

Sales Tax $7,908,601 $7,120,000 $8,020,000 $900,000 12.6% $8,140,300 $1,020,300 14.3%

Rental Income 115,368 153,824 153,824 0 0.0% 153,824 0 0.0%

Interest 96,206 60,000 8,000 (52,000) -86.7% 8,400 (51,600) -86.0%

Total Revenues $8,120,175 $7,333,824 $8,181,824 $848,000 11.6% $8,302,524 $968,700 13.2%

EXPENDITURES

Personnel $248,352 $257,508 $257,508 $0 0.0% $278,743 $21,235 8.2%

Operations $1,142,888 $1,258,980 $1,262,180 3,200 0.3% $1,366,480 107,500 8.5%

Capital $39,761 $45,200 $45,200 0 0.0% $190,200 145,000 320.8%

Total Expenditures $1,431,001 $1,561,688 $1,564,888 $3,200 0.2% $1,835,423 $273,735 17.5%

Net Revenues $6,689,174 $5,772,136 $6,616,936 $844,800 $6,467,101 $694,965

Transfers Out (7,113,484) (5,108,577) (5,142,497) $33,920 (7,128,897) 2,020,320

Proceeds from C.O. Sale 0 0 0 0

Total Other Sources ($7,113,484) ($5,108,577) ($5,142,497) ($7,128,897)

(Uses)

Beginning Fund Balance $9,805,326 $9,381,016 $9,381,016 $10,855,455

Ending Fund Balance $9,381,016 $10,044,575 $10,855,455 $10,193,659

fy 2022 highlighTs:

• The SPDC Operating Fund is projected to receive $8,140,300 in sales tax revenue, $153,824 in rental income, and

$8,400 in interest earnings for total projected FY 2022 revenue of $8,302,524. This represents a projected 13.2%

increase over the FY 2021 Adopted Budget.

• Total expenditures for the Operating Fund are $1,835,423. This is a 17.5% increase from the FY 2021 Adopted

Budget.

• The adopted FY 2022 Budget includes $1,366,480 for operations, $190,200 for capital expenses, and $278,743 for

personnel. SPDC park maintenance costs represent about 37% of the current total park maintenance costs. The

proposal to fund certain maintenance costs in SPDC is balanced with master plan implementation, capital costs,

and fund balance needs.

• The ending fund balance for the SPDC Operating Fund will be $10,193,659.

BUDGET BOOK | FY 2022 City of Southlake 349

WWW.CITYOFSOUTHLAKE.COM