Page 133 - Southlake FY22 Budget

P. 133

CITY PrOFILE

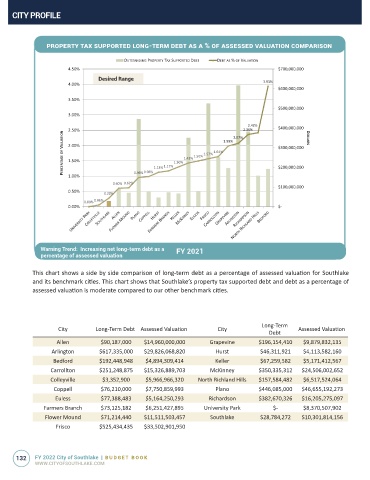

PrOPerTy Tax suPPOrTed lOng-Term deBT as a % Of assessed valuaTiOn COmParisOn

OUTSTANDING PROPERTY TAX SUPPORTED DEBT DEBT AS % OF VALUATION

4.50% $700,000,000

Desired range

4.00% 3.93%

$600,000,000

3.50%

$500,000,000

3.00%

2.42%

2.50% 1.99% 2.07% 2.36% $400,000,000 DOLLARS

PERCENTAGE OF VALUATION 2.00% 1.13% 1.17% 1.30% 1.43% 1.50% 1.57% 1.64% $300,000,000

1.50%

$200,000,000

1.00%

0.60% 0.62% 0.96% 0.98% $100,000,000

0.50% 0.28%

0.00% 0.06%

0.00% $-

Warning Trend: Increasing net long-term debt as a FY 2021

percentage of assessed valuation

This chart shows a side by side comparison of long-term debt as a percentage of assessed valuation for Southlake

and its benchmark cities. This chart shows that Southlake’s property tax supported debt and debt as a percentage of

assessed valuation is moderate compared to our other benchmark cities.

Long-Term

City Long-Term Debt Assessed Valuation City Assessed Valuation

Debt

Allen $90,187,000 $14,960,000,000 Grapevine $196,154,410 $9,879,832,135

Arlington $617,335,000 $29,826,068,820 Hurst $46,311,921 $4,113,582,160

Bedford $192,448,948 $4,894,309,414 Keller $67,259,582 $5,171,412,567

Carrollton $251,248,875 $15,326,889,703 McKinney $350,335,312 $24,506,002,652

Colleyville $3,352,900 $5,966,966,320 North Richland Hills $157,584,482 $6,517,524,064

Coppell $76,210,000 $7,750,859,993 Plano $446,085,000 $46,655,192,273

Euless $77,388,483 $5,164,250,293 Richardson $382,670,326 $16,205,275,097

Farmers Branch $73,125,182 $6,251,427,895 University Park $- $8,370,507,902

Flower Mound $71,214,440 $11,511,503,457 Southlake $28,784,272 $10,301,814,156

Frisco $525,434,435 $33,502,901,950

132 FY 2022 City of Southlake | BUDGET BOOK

WWW.CITYOFSOUTHLAKE.COM