Page 236 - Saginaw FY22 Adopted Annual Budget

P. 236

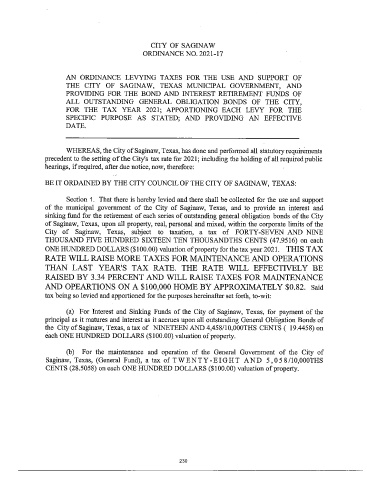

CITY OF SAGINAW

ORDINANCE NO. 2021- 17

AN ORDINANCE LEVYING TAXES FOR THE USE AND SUPPORT OF

THE CITY OF SAGINAW, TEXAS MUNICIPAL GOVERNMENT, AND

PROVIDING FOR THE BOND AND INTEREST RETIREMENT FUNDS OF

ALL OUTSTANDING GENERAL OBLIGATION BONDS OF THE CITY,

FOR THE TAX YEAR 2021; APPORTIONING EACH LEVY FOR THE

SPECIFIC PURPOSE AS STATED; AND PROVIDING AN EFFECTIVE

DATE.

WHEREAS, the City of Saginaw, Texas, has done and performed all statutory requirements

precedent to the setting of the City's tax rate for 2021; including the holding of all required public

hearings, if required, after due notice, now, therefore:

BE IT ORDAINED BY THE CITY COUNCIL OF THE CITY OF SAGINAW, TEXAS:

Section 1. That there is hereby levied and there shall be collected for the use and support

of the municipal government of the City of Saginaw, Texas, and to provide an interest and

sinking fund for the retirement of each series of outstanding general obligation bonds of the City

of Saginaw, Texas, upon all property, real, personal and mixed, within the corporate limits of the

City of Saginaw, Texas, subject to taxation, a tax of FORTY- SEVEN AND NINE

THOUSAND FIVE HUNDRED SIXTEEN TEN THOUSANDTHS CENTS ( 47. 9516) on each

ONE HUNDRED DOLLARS ($100. 00) valuation of for the tax year 2021. THIS TAX

property

RATE WILL RAISE MORE TAXES FOR MAINTENANCE AND OPERATIONS

THAN LAST YEAR'S TAX RATE. THE RATE WILL EFFECTIVELY BE

RAISED BY 3. 34 PERCENT AND WILL RAISE TAXES FOR MAINTENANCE

AND OPEARTIONS ON A $100,000 HOME BY APPROXIMATELY $0. 82. Said

tax being so levied and apportioned for the purposes hereinafter set forth, to-wit:

a) For Interest and Sinking Funds of the City of Saginaw, Texas, for payment of the

principal as it matures and interest as it accrues upon all outstanding General Obligation Bonds of

the City of Saginaw, Texas, a tax of NINETEEN AND 4,458/ 10, 000THS CENTS ( 19.4458) on

each ONE HUNDRED DOLLARS ($ 100.00) valuation of property.

b) For the maintenance and operation of the General Government of the City of

Saginaw, Texas, ( General Fund), a tax of TWENTY- EIGHT AND 5, 0 5 8/ 10,000THS

CENTS ( 28. 5058) on each ONE HUNDRED DOLLARS ($ 100. 00) valuation of

property.

230