Page 2 - Saginaw FY22 Adopted Annual Budget

P. 2

City of Saginaw

Fiscal Year 2021-2022

Adopted Budget Cover Page

August 16, 2021

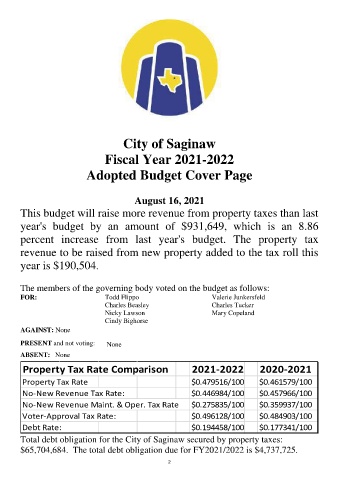

This budget will raise more revenue from property taxes than last

year's budget by an amount of $931,649, which is an 8.86

percent increase from last year's budget. The property tax

revenue to be raised from new property added to the tax roll this

year is $190,504.

The members of the governing body voted on the budget as follows:

FOR: Todd Flippo Valerie Junkersfeld

Charles Beasley Charles Tucker

Nicky Lawson Mary Copeland

Cindy Bighorse

AGAINST: None

PRESENT and not voting: None

ABSENT: None

Property Tax Rate Comparison 2021-2022 2020-2021

Property Tax Rate $0.479516/100 $0.461579/100

No-New Revenue Tax Rate: $0.446984/100 $0.457966/100

No-New Revenue Maint. & Oper. Tax Rate $0.275835/100 $0.359937/100

Voter-Approval Tax Rate: $0.496128/100 $0.484903/100

Debt Rate: $0.194458/100 $0.177341/100

Total debt obligation for the City of Saginaw secured by property taxes:

$65,704,684. The total debt obligation due for FY2021/2022 is $4,737,725.

2