Page 135 - Pantego FY22 Operating Budget

P. 135

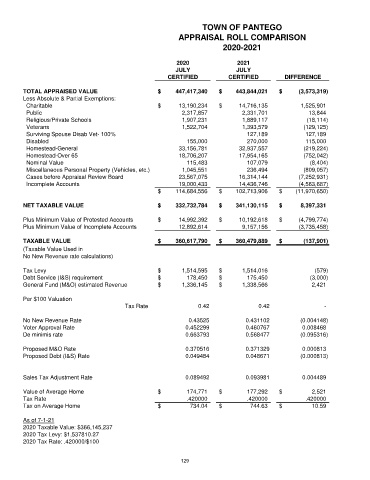

TOWN OF PANTEGO

APPRAISAL ROLL COMPARISON

2020-2021

2020 2021

JULY JULY

CERTIFIED CERTIFIED DIFFERENCE

TOTAL APPRAISED VALUE $ 447,417,340 $ 443,844,021 $ (3,573,319)

Less Absolute & Partial Exemptions:

Charitable $ 13,190,234 $ 14,716,135 1,525,901

Public 2,317,857 2,331,701 13,844

Religious/Private Schools 1,907,231 1,889,117 (18,114)

Veterans 1,522,704 1,393,579 (129,125)

Surviving Spouse Disab Vet- 100% 127,189 127,189

Disabled 155,000 270,000 115,000

Homestead-General 33,156,781 32,937,557 (219,224)

Homestead-Over 65 18,706,207 17,954,165 (752,042)

Nominal Value 115,483 107,079 (8,404)

Miscellaneous Personal Property (Vehicles, etc.) 1,045,551 236,494 (809,057)

Cases before Appraisal Review Board 23,567,075 16,314,144 (7,252,931)

Incomplete Accounts 19,000,433 14,436,746 (4,563,687)

$ 114,684,556 $ 102,713,906 $ (11,970,650)

NET TAXABLE VALUE $ 332,732,784 $ 341,130,115 $ 8,397,331

Plus Minimum Value of Protested Accounts $ 14,992,392 $ 10,192,618 $ (4,799,774)

Plus Minimum Value of Incomplete Accounts 12,892,614 9,157,156 (3,735,458)

TAXABLE VALUE $ 360,617,790 $ 360,479,889 $ (137,901)

(Taxable Value Used in

No New Revenue rate calculations)

Tax Levy $ 1,514,595 $ 1,514,016 (579)

Debt Service (I&S) requirement $ 178,450 $ 175,450 (3,000)

General Fund (M&O) estimated Revenue $ 1,336,145 $ 1,338,566 2,421

Per $100 Valuation

Tax Rate 0.42 0.42 -

No New Revenue Rate 0.43525 0.431102 (0.004148)

Voter Approval Rate 0.452299 0.460767 0.008468

De minimis rate 0.663793 0.568477 (0.095316)

Proposed M&O Rate 0.370516 0.371329 0.000813

Proposed Debt (I&S) Rate 0.049484 0.048671 (0.000813)

Sales Tax Adjustment Rate 0.089492 0.093981 0.004489

Value of Average Home $ 174,771 $ 177,292 $ 2,521

Tax Rate .420000 .420000 .420000

Tax on Average Home $ 734.04 $ 744.63 $ 10.59

As of 7-1-21

2020 Taxable Value: $366,145,237

2020 Tax Levy: $1,537810.27

2020 Tax Rate: .420000/$100

129