Page 127 - Pantego FY22 Operating Budget

P. 127

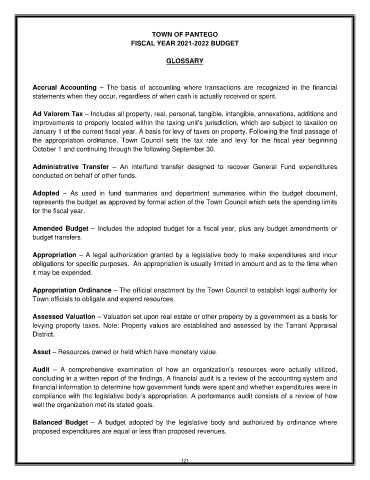

TOWN OF PANTEGO

FISCAL YEAR 2021-2022 BUDGET

GLOSSARY

Accrual Accounting – The basis of accounting where transactions are recognized in the financial

statements when they occur, regardless of when cash is actually received or spent.

Ad Valorem Tax – Includes all property, real, personal, tangible, intangible, annexations, additions and

improvements to property located within the taxing unit’s jurisdiction, which are subject to taxation on

January 1 of the current fiscal year. A basis for levy of taxes on property. Following the final passage of

the appropriation ordinance, Town Council sets the tax rate and levy for the fiscal year beginning

October 1 and continuing through the following September 30.

Administrative Transfer – An interfund transfer designed to recover General Fund expenditures

conducted on behalf of other funds.

Adopted – As used in fund summaries and department summaries within the budget document,

represents the budget as approved by formal action of the Town Council which sets the spending limits

for the fiscal year.

Amended Budget – Includes the adopted budget for a fiscal year, plus any budget amendments or

budget transfers.

Appropriation – A legal authorization granted by a legislative body to make expenditures and incur

obligations for specific purposes. An appropriation is usually limited in amount and as to the time when

it may be expended.

Appropriation Ordinance – The official enactment by the Town Council to establish legal authority for

Town officials to obligate and expend resources.

Assessed Valuation – Valuation set upon real estate or other property by a government as a basis for

levying property taxes. Note: Property values are established and assessed by the Tarrant Appraisal

District.

Asset – Resources owned or held which have monetary value.

Audit – A comprehensive examination of how an organization’s resources were actually utilized,

concluding in a written report of the findings. A financial audit is a review of the accounting system and

financial information to determine how government funds were spent and whether expenditures were in

compliance with the legislative body’s appropriation. A performance audit consists of a review of how

well the organization met its stated goals.

Balanced Budget – A budget adopted by the legislative body and authorized by ordinance where

proposed expenditures are equal or less than proposed revenues.

121