Page 72 - City of Mansfield FY22 Operarting Budget

P. 72

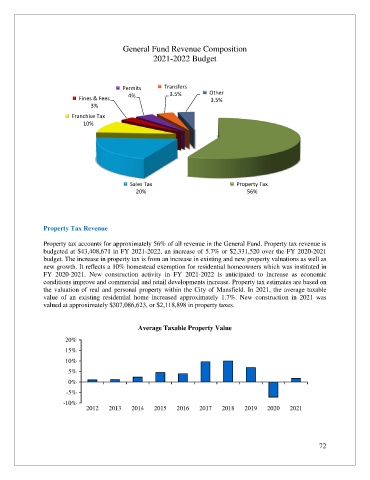

General Fund Revenue Composition

2021-2022 Budget

Permits Transfers Other

Fines & Fees 4% 3.5% 3.5%

3%

Franchise Tax

10%

Sales Tax Property Tax

20% 56%

Property Tax Revenue

Property tax accounts for approximately 56% of all revenue in the General Fund. Property tax revenue is

budgeted at $43,408,671 in FY 2021-2022, an increase of 5.7% or $2,331,520 over the FY 2020-2021

budget. The increase in property tax is from an increase in existing and new property valuations as well as

new growth. It reflects a 10% homestead exemption for residential homeowners which was instituted in

FY 2020-2021. New construction activity in FY 2021-2022 is anticipated to increase as economic

conditions improve and commercial and retail developments increase. Property tax estimates are based on

the valuation of real and personal property within the City of Mansfield. In 2021, the average taxable

value of an existing residential home increased approximately 1.7%. New construction in 2021 was

valued at approximately $307,086,623, or $2,118,898 in property taxes.

Average Taxable Property Value

20%

15%

10%

5%

0%

-5%

-10%

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

72