Page 125 - City of Mansfield FY22 Operarting Budget

P. 125

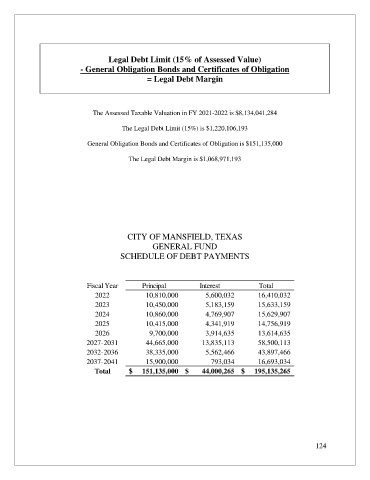

Legal Debt Limit (15% of Assessed Value)

- General Obligation Bonds and Certificates of Obligation

= Legal Debt Margin

The Assessed Taxable Valuation in FY 2021-2022 is $8,134,041,284

The Legal Debt Limit (15%) is $1,220,106,193

General Obligation Bonds and Certificates of Obligation is $151,135,000

The Legal Debt Margin is $1,068,971,193

CITY OF MANSFIELD, TEXAS

GENERAL FUND

SCHEDULE OF DEBT PAYMENTS

Fiscal Year Principal Interest Total

2022 10,810,000 5,600,032 16,410,032

2023 10,450,000 5,183,159 15,633,159

2024 10,860,000 4,769,907 15,629,907

2025 10,415,000 4,341,919 14,756,919

2026 9,700,000 3,914,635 13,614,635

2027-2031 44,665,000 13,835,113 58,500,113

2032-2036 38,335,000 5,562,466 43,897,466

2037-2041 15,900,000 793,034 16,693,034

Total $ 151,135,000 $ 44,000,265 $ 195,135,265

124