Page 4 - Lakeside FY22 Operating Budget

P. 4

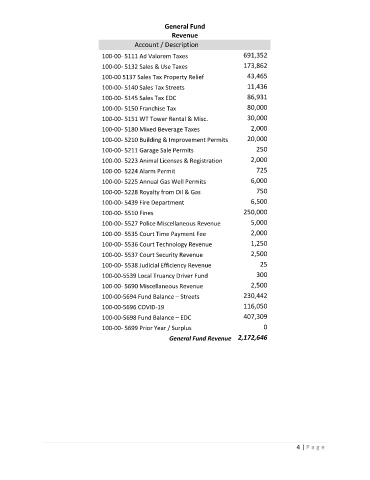

General Fund

Revenue

Account / Description

100-00- 5111 Ad Valorem Taxes 691,352

100-00- 5132 Sales & Use Taxes 173,862

100-00 5137 Sales Tax Property Relief 43,465

100-00- 5140 Sales Tax Streets 11,436

100-00- 5145 Sales Tax EDC 86,931

100-00- 5150 Franchise Tax 80,000

100-00- 5151 WT Tower Rental & Misc. 30,000

100-00- 5180 Mixed Beverage Taxes 2,000

100-00- 5210 Building & Improvement Permits 20,000

100-00- 5211 Garage Sale Permits 250

100-00- 5223 Animal Licenses & Registration 2,000

100-00- 5224 Alarm Permit 725

100-00- 5225 Annual Gas Well Permits 6,000

100-00- 5228 Royalty from Oil & Gas 750

100-00- 5439 Fire Department 6,500

100-00- 5510 Fines 250,000

100-00- 5527 Police Miscellaneous Revenue 5,000

100-00- 5535 Court Time Payment Fee 2,000

100-00- 5536 Court Technology Revenue 1,250

100-00- 5537 Court Security Revenue 2,500

100-00- 5538 Judicial Efficiency Revenue 25

100-00-5539 Local Truancy Driver Fund 300

100-00- 5690 Miscellaneous Revenue 2,500

100-00-5694 Fund Balance – Streets 230,442

100-00-5696 COVID-19 116,050

100-00-5698 Fund Balance – EDC 407,309

100-00- 5699 Prior Year / Surplus 0

General Fund Revenue 2,172,646

4 | P a g e