Page 388 - Microsoft Word - FY 2021 tax info sheet

P. 388

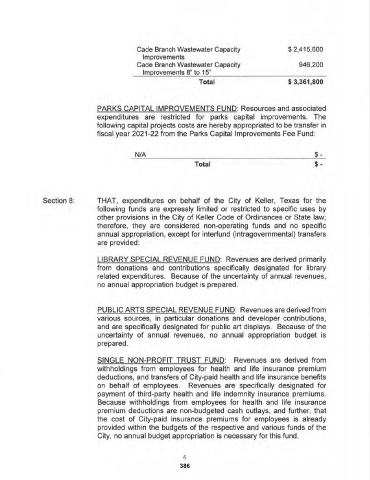

Cade Branch Wastewater Capacity $ 2,415,600

Improvements

Cade Branch Wastewater Capacity 946,200

Improvements 8" to 15"

Total $3,361,800

PARKS CAPITAL IMPROVEMENTS FUND: Resources and associated

expenditures are restricted for parks capital improvements. The

following capital projects costs are hereby appropriated to be transfer in

fiscal year 2021-22 from the Parks Capital Improvements Fee Fund:

N/A $-

Total $.

Section 8: THAT, expenditures on behalf of the City of Keller, Texas for the

following funds are expressly limited or restricted to specific uses by

other provisions in the City of Keller Code of Ordinances or State law;

therefore, they are considered non-operating funds and no specific

annual appropriation, except for interfund (intragovernmental) transfers

are provided:

LIBRARY SPECIAL REVENUE FUND: Revenues are derived primarily

from donations and contributions specifically designated for library

related expenditures. Because of the uncertainty of annual revenues,

no annual appropriation budget is prepared.

PUBLIC ARTS SPECIAL REVENUE FUND: Revenues are derived from

various sources, in particular donations and developer contributions,

and are specifically designated for public art displays. Because of the

uncertainty of annual revenues, no annual appropriation budget is

prepared.

SINGLE NON-PROFIT TRUST FUND: Revenues are derived from

withholdings from employees for health and life insurance premium

deductions, and transfers of City-paid health and life insurance benefits

on behalf of employees. Revenues are specifically designated for

payment of third-party health and life indemnity insurance premiums.

Because withholdings from employees for health and life insurance

premium deductions are non-budgeted cash outlays, and further, that

the cost of City-paid insurance premiums for employees is already

provided within the budgets of the respective and various funds of the

City, no annual budget appropriation is necessary for this fund.

4

386