Page 76 - Hurst Adopted FY22 Budget

P. 76

APPROVED FISCAL YEAR 2022 BUDGET

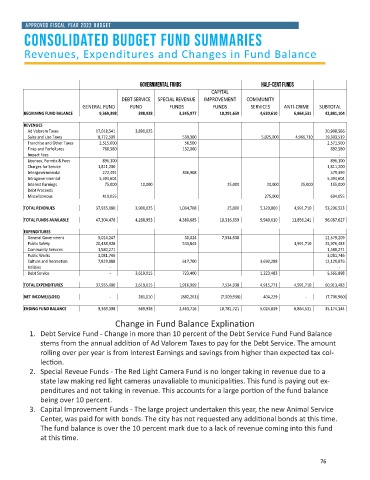

Consolidated Budget Fund Summaries

Revenues, Expenditures and Changes in Fund Balance

GOVERNMENTAL FUNDS HALF-CENT FUNDS

CAPITAL

DEBT SERVICE SPECIAL REVENUE IMPROVEMENT COMMUNITY

GENERAL FUND FUND FUNDS FUNDS SERVICES ANTI-CRIME SUBTOTAL

BEGINNING FUND BALANCE 9,369,398 388,928 3,345,977 18,291,659 4,620,610 6,864,531 42,881,104

REVENUES

Ad Valorem Taxes 17,018,541 3,890,025 20,908,566

Sales and Use Taxes 8,772,509 539,300 5,025,000 4,966,710 19,303,519

Franchise and Other Taxes 2,515,000 56,500 2,571,500

Fines and Forfeitures 760,580 132,000 892,580

Impact Fees -

Licenses, Permits & Fees 896,100 896,100

Charges for Service 1,811,200 1,811,200

Intergovernmental 272,491 306,908 579,399

Intragovernmental 5,394,604 5,394,604

Interest Earnings 75,000 10,000 25,000 20,000 25,000 155,000

Debt Proceeds -

Miscellaneous 419,055 275,000 694,055

TOTAL REVENUES 37,935,080 3,900,025 1,034,708 25,000 5,320,000 4,991,710 53,206,523

TOTAL FUNDS AVAILABLE 47,304,478 4,288,953 4,380,685 18,316,659 9,940,610 11,856,241 96,087,627

EXPENDITURES

General Government 5,014,247 30,024 7,534,938 12,579,209

Public Safety 20,438,928 545,845 4,991,710 25,976,483

Community Services 1,580,271 1,580,271

Public Works 3,081,746 3,081,746

Culture and Recreation 7,819,888 617,700 3,692,288 12,129,876

Utilities - -

Debt Service - 3,619,015 723,400 1,223,483 5,565,898

TOTAL EXPENDITURES 37,935,080 3,619,015 1,916,969 7,534,938 4,915,771 4,991,710 60,913,483

NET INCOME/(LOSS) - 281,010 (882,261) (7,509,938) 404,229 - (7,706,960)

ENDING FUND BALANCE 9,369,398 669,938 2,463,716 10,781,721 5,024,839 6,864,531 35,174,144

Change in Fund Balance Explination

1. Debt Service Fund - Change in more than 10 percent of the Debt Service Fund Fund Balance

stems from the annual addition of Ad Valorem Taxes to pay for the Debt Service. The amount

rolling over per year is from Interest Earnings and savings from higher than expected tax col-

lection.

2. Special Reveue Funds - The Red Light Camera Fund is no longer taking in revenue due to a

state law making red light cameras unavaliable to municipalities. This fund is paying out ex-

penditures and not taking in revenue. This accounts for a large portion of the fund balance

being over 10 percent.

3. Capital Improvement Funds - The large project undertaken this year, the new Animal Service

Center, was paid for with bonds. The city has not requested any additional bonds at this time.

The fund balance is over the 10 percent mark due to a lack of revenue coming into this fund

at this time.

76