Page 3 - Hurst Adopted FY22 Budget

P. 3

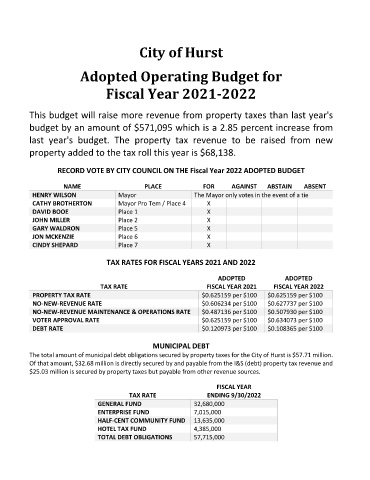

City of Hurst

Adopted Operating Budget for

Fiscal Year 2021-2022

This budget will raise more revenue from property taxes than last year's

budget by an amount of $571,095 which is a 2.85 percent increase from

last year's budget. The property tax revenue to be raised from new

property added to the tax roll this year is $68,138.

RECORD VOTE BY CITY COUNCIL ON THE Fiscal Year 2022 ADOPTED BUDGET

NAME PLACE FOR AGAINST ABSTAIN ABSENT

HENRY WILSON Mayor The Mayor only votes in the event of a tie

CATHY BROTHERTON Mayor Pro Tem / Place 4 X

DAVID BOOE Place 1 X

JOHN MILLER Place 2 X

GARY WALDRON Place 5 X

JON MCKENZIE Place 6 X

CINDY SHEPARD Place 7 X

TAX RATES FOR FISCAL YEARS 2021 AND 2022

ADOPTED ADOPTED

TAX RATE FISCAL YEAR 2021 FISCAL YEAR 2022

PROPERTY TAX RATE $0.625159 per $100 $0.625159 per $100

NO-NEW-REVENUE RATE $0.606234 per $100 $0.627737 per $100

NO-NEW-REVENUE MAINTENANCE & OPERATIONS RATE $0.487136 per $100 $0.507930 per $100

VOTER APPROVAL RATE $0.625159 per $100 $0.634073 per $100

DEBT RATE $0.120973 per $100 $0.108365 per $100

MUNICIPAL DEBT

The total amount of municipal debt obligations secured by property taxes for the City of Hurst is $57.71 million.

Of that amount, $32.68 million is directly secured by and payable from the I&S (debt) property tax revenue and

$25.03 million is secured by property taxes but payable from other revenue sources.

FISCAL YEAR

TAX RATE ENDING 9/30/2022

GENERAL FUND 32,680,000

ENTERPRISE FUND 7,015,000

HALF-CENT COMMUNITY FUND 13,635,000

HOTEL TAX FUND 4,385,000

TOTAL DEBT OBLIGATIONS 57,715,000