Page 22 - Hurst Adopted FY22 Budget

P. 22

GENERAL FUND

The General Fund is the main fund of the City. The revenues of the General Fund come mainly from

Property Taxes and Sales Taxes. Services funded by the General Fund include everything from the City

Manager’s office to the Police Department. If you have dealt with a main City department more than

likely this department was paid for through the General Fund.

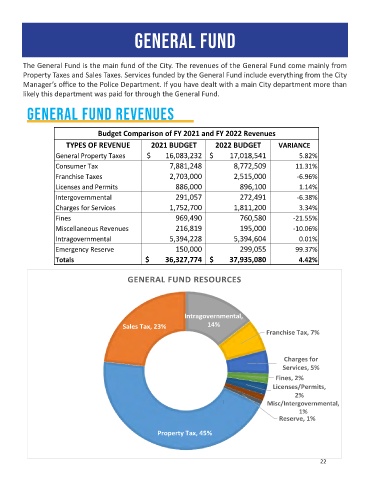

general fund revenues

Budget Comparison of FY 2021 and FY 2022 Revenues

TYPES OF REVENUE 2021 BUDGET 2022 BUDGET VARIANCE

General Property Taxes $ 16,083,232 $ 17,018,541 5.82%

Consumer Tax 7,881,248 8,772,509 11.31%

Franchise Taxes 2,703,000 2,515,000 -6.96%

Licenses and Permits 886,000 896,100 1.14%

Intergovernmental 291,057 272,491 -6.38%

Charges for Services 1,752,700 1,811,200 3.34%

Fines 969,490 760,580 -21.55%

Miscellaneous Revenues 216,819 195,000 -10.06%

Intragovernmental 5,394,228 5,394,604 0.01%

Emergency Reserve 150,000 299,055 99.37%

Totals $ 36,327,774 $ 37,935,080 4.42%

GENERAL FUND RESOURCES

Intragovernmental,

Sales Tax, 23% 14%

Franchise Tax, 7%

Charges for

Services, 5%

Fines, 2%

Licenses/Permits,

2%

Misc/Intergovernmental,

1%

Reserve, 1%

Property Tax, 45%

22