Page 3 - Haltom City FY 22 Budget

P. 3

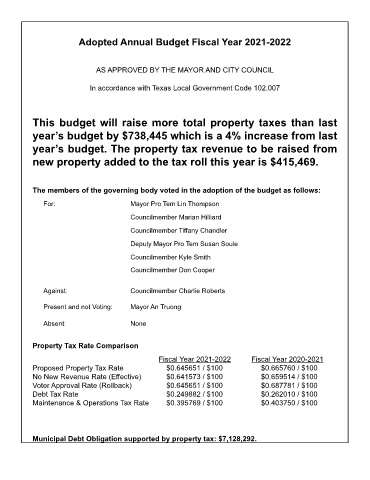

Adopted Annual Budget Fiscal Year 2021-2022

AS APPROVED BY THE MAYOR AND CITY COUNCIL

In accordance with Texas Local Government Code 102.007

This budget will raise more total property taxes than last

year’s budget by $738,445 which is a 4% increase from last

year’s budget. The property tax revenue to be raised from

new property added to the tax roll this year is $415,469.

The members of the governing body voted in the adoption of the budget as follows:

For: Mayor Pro Tem Lin Thompson

Councilmember Marian Hilliard

Councilmember Tiffany Chandler

Deputy Mayor Pro Tem Susan Soule

Councilmember Kyle Smith

Councilmember Don Cooper

Against: Councilmember Charlie Roberts

Present and not Voting: Mayor An Truong

Absent: None

Property Tax Rate Comparison

Fiscal Year 2021-2022 Fiscal Year 2020-2021

Proposed Property Tax Rate $0.645651 / $100 $0.665760 / $100

No New Revenue Rate (Effective) $0.641573 / $100 $0.659514 / $100

Voter Approval Rate (Rollback) $0.645651 / $100 $0.687781 / $100

Debt Tax Rate $0.249882 / $100 $0.262010 / $100

Maintenance & Operations Tax Rate $0.395769 / $100 $0.403750 / $100

Municipal Debt Obligation supported by property tax: $7,128,292.