Page 3 - FortWorthFY22AdoptedBudget

P. 3

Truth in Taxation

CITY OF FORT WORTH, TEXAS

FISCAL YEAR 2021-2022

ANNUAL BUDGET

This budget will raise more revenue from property taxes than last year’s budget by

an amount of $42,924,585, which is a 7.2 percent increase from last year’s budget.

The property tax revenue to be raised from new property added to the tax roll this

year is $24,063,165.

CITY COUNCIL RECORD VOTE

The members of the governing body voted on the adoption of the budget as

follows:

FOR: Mayor Mattie Parker, Council Members Carlos Flores, Michael D. Crain,

Cary Moon, Gyna Bivens, Jared Williams, Leonard Firestone, Chris Nettles and

Elizabeth Beck

AGAINST: None

PRESENT but abstained from voting: None

ABSENT: None

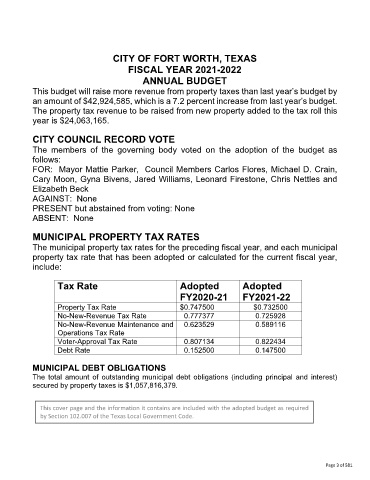

MUNICIPAL PROPERTY TAX RATES

The municipal property tax rates for the preceding fiscal year, and each municipal

property tax rate that has been adopted or calculated for the current fiscal year,

include:

Tax Rate Adopted Adopted

FY2020-21 FY2021-22

Property Tax Rate $0.747500 $0.732500

No-New-Revenue Tax Rate 0.777377 0.725928

No-New-Revenue Maintenance and 0.623529 0.589116

Operations Tax Rate

Voter-Approval Tax Rate 0.807134 0.822434

Debt Rate 0.152500 0.147500

MUNICIPAL DEBT OBLIGATIONS

The total amount of outstanding municipal debt obligations (including principal and interest)

secured by property taxes is $1,057,816,379.

This cover page and the information it contains are included with the adopted budget as required

by Section 102.007 of the Texas Local Government Code.

Page 3 of 581