Page 235 - FortWorthFY22AdoptedBudget

P. 235

Enterprise Funds

Enterprise Fund Statement

FUND SUMMARY

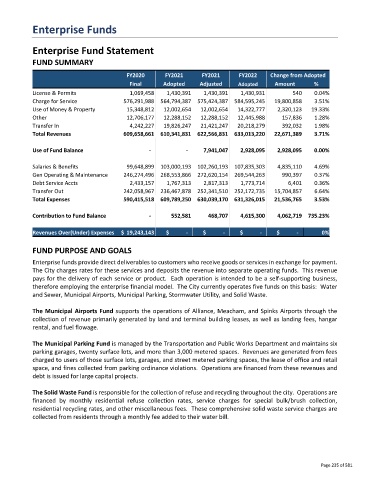

FY2020 FY2021 FY2021 FY2022 Change from Adopted

Final Adopted Adjusted Adopted Amount %

License & Permits 1,069,458 1,430,391 1,430,391 1,430,931 540 0.04%

Charge for Service 576,291,988 564,794,387 575,424,387 584,595,245 19,800,858 3.51%

Use of Money & Property 15,348,812 12,002,654 12,002,654 14,322,777 2,320,123 19.33%

Other 12,706,177 12,288,152 12,288,152 12,445,988 157,836 1.28%

Transfer In 4,242,227 19,826,247 21,421,247 20,218,279 392,032 1.98%

Total Revenues 609,658,661 610,341,831 622,566,831 633,013,220 22,671,389 3.71%

Use of Fund Balance - - 7,941,047 2,928,095 2,928,095 0.00%

Salaries & Benefits 99,648,899 103,000,193 102,260,193 107,835,303 4,835,110 4.69%

Gen Operating & Maintenance 246,274,496 268,553,866 272,620,154 269,544,263 990,397 0.37%

Debt Service Accts 2,433,157 1,767,313 2,817,313 1,773,714 6,401 0.36%

Transfer Out 242,058,967 236,467,878 252,341,510 252,172,735 15,704,857 6.64%

Total Expenses 590,415,518 609,789,250 630,039,170 631,326,015 21,536,765 3.53%

Contribution to Fund Balance - 552,581 468,707 4,615,300 4,062,719 735.23%

Revenues Over(Under) Expenses $ 19,243,143 $ - $ - $ - $ - 0%

FUND PURPOSE AND GOALS

Enterprise funds provide direct deliverables to customers who receive goods or services in exchange for payment.

The City charges rates for these services and deposits the revenue into separate operating funds. This revenue

pays for the delivery of each service or product. Each operation is intended to be a self-supporting business,

therefore employing the enterprise financial model. The City currently operates five funds on this basis: Water

and Sewer, Municipal Airports, Municipal Parking, Stormwater Utility, and Solid Waste.

The Municipal Airports Fund supports the operations of Alliance, Meacham, and Spinks Airports through the

collection of revenue primarily generated by land and terminal building leases, as well as landing fees, hangar

rental, and fuel flowage.

The Municipal Parking Fund is managed by the Transportation and Public Works Department and maintains six

parking garages, twenty surface lots, and more than 3,000 metered spaces. Revenues are generated from fees

charged to users of those surface lots, garages, and street metered parking spaces, the lease of office and retail

space, and fines collected from parking ordinance violations. Operations are financed from these revenues and

debt is issued for large capital projects.

The Solid Waste Fund is responsible for the collection of refuse and recycling throughout the city. Operations are

financed by monthly residential refuse collection rates, service charges for special bulk/brush collection,

residential recycling rates, and other miscellaneous fees. These comprehensive solid waste service charges are

collected from residents through a monthly fee added to their water bill.

Page 235 of 581