Page 6 - Forest Hill FY22 Annual Budget

P. 6

c:::o I:..�

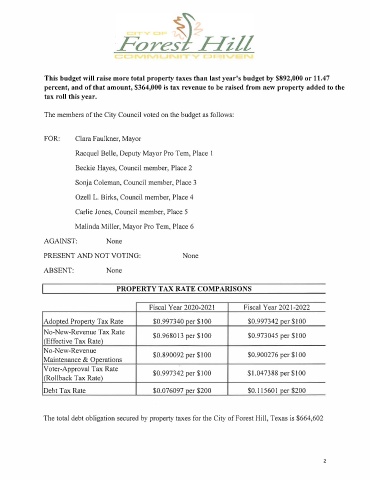

This budget will raise more total property taxes than last year's budget by $892,000 or 11.47

percent, and of that amount, S364,000 is tax revenue to be raised from new property added to the

tax roll this year.

The members of the City Council voted on the budget as follows:

FOR: Clara Faulkner, Mayor

Racquel Belle, Deputy Mayor Pro Tern, Place 1

Beckie Hayes, Council member, Place 2

Sonja Coleman, Council member, Place 3

Ozell L. Birks, Council member, Place 4

Carlie Jones, Council member, Place 5

Malinda Miller, Mayor Pro Tern, Place 6

AGAINST: None

PRESENT AND NOT VOTING: None

ABSENT: None

PROPERTY TAX RA TE COMPARISONS

Fiscal Year 2020-2021 Fiscal Year 2021-2022

Adopted Property Tax Rate $0.997340 per $100 $0.997342 per $100

No-New-Revenue Tax Rate $0.968013 per $100 $0.973045 per $100

(Effective Tax Rate)

No-New-Revenue $0.890092 per $100 $0.900276 per $100

Maintenance & Operations

Voter-Approval Tax Rate $0.997342 per $100 $1.047388 per $100

(Rollback Tax Rate)

Debt Tax Rate $0.076097 per $200 $0.115601 per $200

The total debt obligation secured by property taxes for the City of Forest Hill, Texas is $664,602

2