Page 21 - City of Crowley FY22 Operating Budget

P. 21

TNT -212 08 -20118

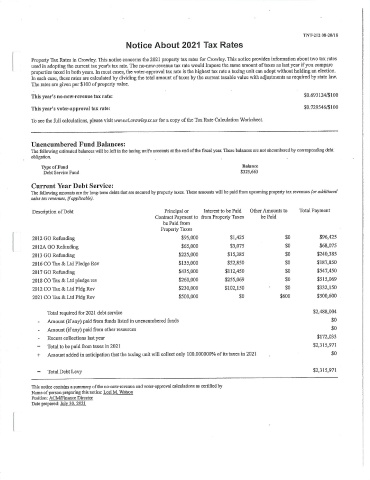

Notice About 2021 Tax Rates

Property Tax Rates in Crowley. This notice concerns the 2021 property tax rates for Crowley. This notice provides information about two tax rates

used in adopting the current tax year's tax rate. The no- new - revenue tax rate would Impose the same amount oftaxes as last year ifyou compare

properties taxed in both years. In most cases, the voter - approval tax rate is the highest tax rate a taxing unit can adopt without holding an election.

In each case, these rates are calculated by dividing the total amount oftaxes by the current taxable value with adjustments as required by state law.

The rates are given per $ 100 of property value.

This year' s no- new-revenue tax rate: $ 0.693124/$ 100

This year' s voter - approval tax rate: $ 0.729546/$ 100

To see the full calculations, please visit tvtPtt: ci.crowley.tv.its for a copy of the Tax Rate Calculation Worksheet.

Unencumbered Fund Balances:

The following estimated balances will be left in the taxing unit's accounts at the end ofthe fiscal year. These balances are not ehcumbered by corresponding debt

obligation.

Type of fund Balance

Debt Service Fund 325, 663

Current Year Debt Service:

The following amounts are for long -term debts that are secured by property taxes. These amounts will be paid from upcoming property tax revenues (or additional

sales tar revenues, ifapplicable).

Description ofDebt Principal or Interest to be Paid Other Amounts to Total Payment

Contract Payment to from Property Taxes be Paid

be Paid from

Property Taxes

2012 GO Refunding 95, 000 1, 425 0 96,425

2012A GO Refunding 65,000 3, 075 0 68, 075

2013 GO Refunding 225, 000 15,385 0 240,385

2016 CO Tax & Ltd Pledge Rev 135, 000 52,850 0 187, 850

2017 GO Refunding 435,000 112,450 0 547,450

2018 CO Tax & Ltd pledge rev 260,000 255,069 0 515, 069

2012 CO Tax & Ltd Pldg Rev 230,000 102, 150 0 332, 150

2021 CO Tax & Ltd Pldg Rev 500,000 0 600 500,600

Total required for 2021 debt service $ 2,488, 004

Amount (if any) paid from funds listed in unencumbered funds $ 0

Amount (if any) paid from other resources $ 0

172, 033

Excess collections last year $

Total to be paid from taxes in 2021 $ 2, 315, 971

Amount added in anticipation that the taxing unit will collect only 100.000000% of its taxes in 2021 $ 0

2,315, 971

TotalDebtLevy $

This notice contains a summary ofthe no -new- revenue and voter - approval calculations as certified by

Name ofperson preparing this notice: Lori M. Watson

Position: ACM/Finance Director

Date prepared: July 30, 2021