Page 205 - Burleson FY22 City Budget

P. 205

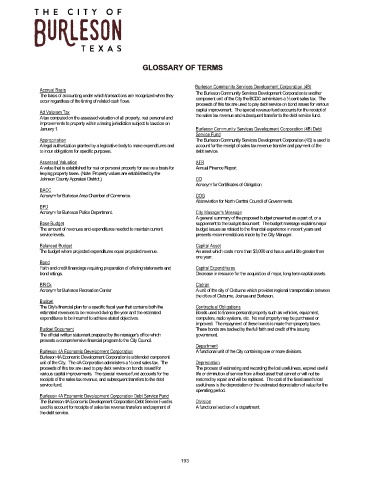

GLOSSARY OF TERMS

Burleson Community Services Development Corporation (4B)

Accrual Basis

The basis of accounting under which transactions are recognized when they The Burleson Community Services Development Corporation is another

occur regardless of the timing of related cash flows. component unit of the City the BCDC administers a ½ cent sales tax. The

proceeds of this tax are used to pay debt service on bond issues for various

Ad Valorem Tax capital improvement. The special revenue fund accounts for the receipt of

A tax computed on the assessed valuation of all property, real personal and the sales tax revenue and subsequent transfer to the debt service fund.

improvements to property within a taxing jurisdiction subject to taxation on

January 1. Burleson Community Services Development Corporation (4B) Debt

Service Fund

Appropriation The Burleson Community Services Development Corporation (4B) is used to

A legal authorization granted by a legislative body to make expenditures and account for the receipt of sales tax revenue transfer and payment of the

to incur obligations for specific purposes. debt service.

Assessed Valuation AFR

A value that is established for real or personal property for use as a basis for Annual Finance Report

levying property taxes. (Note: Property values are established by the

Johnson County Appraisal District.) CO

Acronym for Certificates of Obligation.

BACC

Acronym for Burleson Area Chamber of Commerce. COG

Abbreviation for North Central Council of Governments.

BPD

Acronym for Burleson Police Department. City Manager's Message

A general summary of the proposed budget presented as a part of, or a

Base Budget supplement to the budget document. The budget message explains major

The amount of revenues and expenditures needed to maintain current budget issues as related to the financial experience in recent years and

service levels. presents recommendations made by the City Manager.

Balanced Budget Capital Asset

The budget where projected expenditures equal projected revenue. An asset which costs more than $3,000 and has a useful life greater than

one year.

Bond

Faith and credit financings requiring preparation of offering statements and Capital Expenditures

bond ratings. Decrease in resource for the acquisition of major, long term capital assets.

BRiCk Cletran

Acronym for Burleson Recreation Center A unit of the city of Cleburne which provides regional transportation between

the cities of Cleburne, Joshua and Burleson.

Budget

The City's financial plan for a specific fiscal year that contains both the Contractual Obligations

estimated revenues to be received during the year and the estimated Bonds used to finance personal property such as vehicles, equipment,

expenditures to be incurred to achieve stated objectives. computers, radio systems, etc. No real property may be purchased or

improved. The repayment of these bonds is made from property taxes.

Budget Document These bonds are backed by the full faith and credit of the issuing

The official written statement prepared by the manager's office which government.

presents a comprehensive financial program to the City Council.

Department

Burleson 4A Economic Development Corporation A functional unit of the City containing one or more divisions.

Burleson 4A Economic Development Corporation is a blended component

unit of the City. The 4A Corporation administers a ½ cent sales tax. The Depreciation

proceeds of this tax are used to pay debt service on bonds issued for The process of estimating and recording the lost usefulness, expired useful

various capital improvements. The special revenue fund accounts for the life or diminution of service from a fixed asset that cannot or will not be

receipts of the sales tax revenue, and subsequent transfers to the debt restored by repair and will be replaced. The cost of the fixed asset's lost

service fund. usefulness is the depreciation or the estimated depreciation of value for the

operating period.

Burleson 4A Economic Development Corporation Debt Service Fund

The Burleson 4A Economic Development Corporation Debt Service Fund is Division

used to account for receipts of sales tax revenue transfers and payment of A functional section of a department.

the debt service.

193