Page 127 - Burleson FY22 City Budget

P. 127

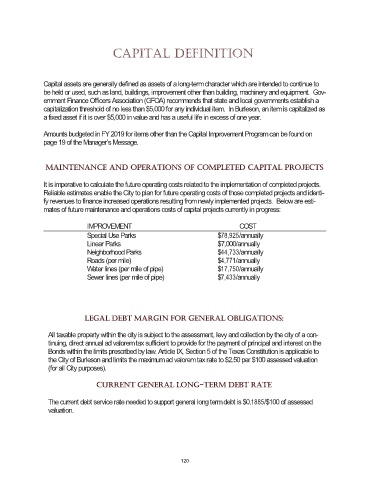

capital definition

Capital assets are generally defined as assets of a long-term character which are intended to continue to

be held or used, such as land, buildings, improvement other than building, machinery and equipment. Gov-

ernment Finance Officers Association (GFOA) recommends that state and local governments establish a

capitalization threshold of no less than $5,000 for any individual item. In Burleson, an item is capitalized as

a fixed asset if it is over $5,000 in value and has a useful life in excess of one year.

Amounts budgeted in FY 2019 for items other than the Capital Improvement Program can be found on

page 19 of the Manager’s Message.

MAINTENANCE AND OPERATIONS OF COMPLETED CAPITAL PROJECTS

It is imperative to calculate the future operating costs related to the implementation of completed projects.

Reliable estimates enable the City to plan for future operating costs of those completed projects and identi-

fy revenues to finance increased operations resulting from newly implemented projects. Below are esti-

mates of future maintenance and operations costs of capital projects currently in progress:

IMPROVEMENT COST

Special Use Parks $78,925/annually

Linear Parks $7,000/annually

Neighborhood Parks $44,733/annually

Roads (per mile) $4,771/annually

Water lines (per mile of pipe) $17,750/annually

Sewer lines (per mile of pipe) $7,433/annually

LEGAL DEBT MARGIN FOR GENERAL OBLIGATIONS:

All taxable property within the city is subject to the assessment, levy and collection by the city of a con-

tinuing, direct annual ad valorem tax sufficient to provide for the payment of principal and interest on the

Bonds within the limits prescribed by law. Article IX, Section 5 of the Texas Constitution is applicable to

the City of Burleson and limits the maximum ad valorem tax rate to $2.50 per $100 assessed valuation

(for all City purposes).

CURRENT GENERAL LONG-TERM DEBT RATE

The current debt service rate needed to support general long term debt is $0.1885/$100 of assessed

valuation.

120