Page 88 - FY 2021-22 ADOPTED BUDGET

P. 88

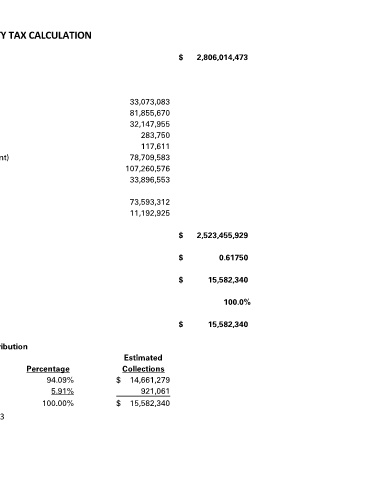

FY 2021-22 PROPERTY TAX CALCULATION

GROSS VALUATION $ 2,806,014,473

Less:

Exemptions and Adjustments

Veterans 33,073,083

Over-65 81,855,670

Homestead 32,147,955

Disabled Person 283,750

Other 117,611

Absolute Exemptions (churches, schools, and government) 78,709,583

Cases Before ARB 107,260,576

Incomplete, Pro-Rated, and Nominal Accounts 33,896,553

Add:

TAD Projected Value of Property Under Protest 73,593,312

Minimum Value of Incomplete Accounts 11,192,925

NET TAXABLE VALUE $ 2,523,455,929

Rate Per $100 Valuation $ 0.61750

2021-22 Tax Levy $ 15,582,340

Collection rate 100.0%

TOTAL FY 2021-22 ESTIMATED PROPERTY TAX COLLECTIONS $ 15,582,340

Tax Distribution

Estimated

Fund Tax Rate Percentage Collections

General Fund 0.58100 94.09% $ 14,661,279

Debt Service Fund 0.03650 5.91% 921,061

Totals 0.61750 100.00% $ 15,582,340

73